National Financial Educators Council Reviews Florida Financial Literacy Standards & Mandates

Florida Fails to Meet Education Standards or Prepare Students for Financial Decisions, According to the NFEC

JACKSONVILLE, FLORIDA, UNITED STATES, July 17, 2024 /EINPresswire.com/ -- Florida SB 1054, the Dorothy L. Hukill Financial Literacy Act, has mandated personal finance instruction for students in the state’s high schools. These provisions took effect July 1, 2022, and require students to take a financial literacy course.

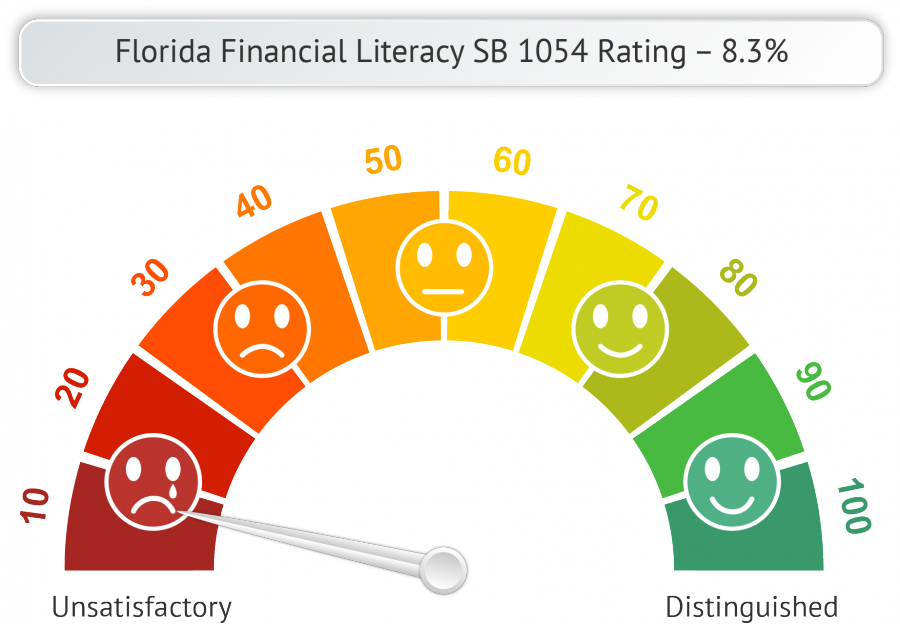

According to the National Financial Educators Council (NFEC), the state mandate falls short of meeting minimum education standards and does not prepare youth for near-term financial decisions. The NFEC gives the bill an overall rating of 8.3% out of 100.

According to Vince Shorb, CEO of the NFEC, “While the bill is well-intentioned, it does not meet the educational standards necessary for ensuring optimal student outcomes. The legislation lacks the rigor and pedagogical depth required to match the standards upheld in other subjects.”

The National Financial Educators Council rated Florida’s financial literacy standards and mandates across 12 different areas. These areas outline minimum education standards of other core high school level topics, yet are absent in most financial literacy standards and mandates. Following are the 12 categories across which the NFEC rates state-level standards for financial education:

Program Structure:

· Delivered in standalone classes and integrated into other subjects.

· Assign adequate time and level of rigor to the subject matter.

· Conduct ongoing education to support long-term outcomes.

Lesson Plans:

· Relevant content that prepares students for financial life events.

· Adopt a proven curriculum that encourages higher-order thinking and application.

· Customize lesson plans based on socio-economic status.

Educators & Leadership:

· Courses led by highly qualified personal finance educators.

· Program development and deployment managed by experienced leaders.

· Learner outcomes focused on long-term financial wellness and early indicators.

Program Support:

· Fund financial literacy programs.

· Encourage parental involvement and provide parents with access to resources.

· Start financial education courses in elementary school.

According to the NFEC the Florida financial literacy mandates only conditionally pass in 2 areas: 1) delivered in standalone classes and integrated into other subjects, and 2) funding to implement financial education programming.

“I want to acknowledge the dedicated efforts that have brought SB 1054 to the forefront of Florida's legislative agenda,” states Dr. Renée Baker, founder of the RBI Group and financial literacy advocate. “However, the NFEC's recent findings show that while we're making strides, our financial literacy programs in the state of Florida conditionally pass in critical areas like integration and funding. This reveals a significant gap in our commitment to fully prepare our students for financial independence. We need a comprehensive statewide financial education mandate that robustly addresses these deficiencies.”

Evelyn Magley, CEO The Basketball League/Basketball Super League and Florida Financial Educators Council board member comments, "Comprehensive financial education is fundamental to our youth's future success. It goes beyond mere budgeting; it empowers them with the essential knowledge and skills to confidently navigate the intricacies of financial decision-making across their lifetimes. Without these critical life skills, youth may fall short of realizing their full potential to build a lasting financial legacy for themselves and future generations."

To help address the concerns raised, the National Financial Educators Council (NFEC) has developed a set of benchmarks for financial education at all grade levels, K-12. Policymakers can consult a guide – the “Policy and Standards Framework for High School Financial Education” – to help craft legislation that ensures the educational quality and learner outcomes to provide Florida youth with the best possible financial wellness education.

The NFEC’s Policy & Standards Framework for High School Financial Literacy Education establishes two core objectives:

1) Elevate financial education mandates to meet standards of other core subjects;

2) Prepare every high school graduate to make near-term financial decisions.

"When financial literacy is not held to high standards, our youth bear the consequences," remarks Vince Shorb, CEO of the NFEC. "Florida’s proposed financial literacy bill does not meet even the basic educational standards applied to other subjects. As a result, students will graduate without the capability to make informed near-term financial decisions, potentially facing the same financial struggles that many young people experience on their path to independence."

As an IACET Accredited provider, the National Financial Educators Council® offers IACET CEUs for its learning events that comply with the ANSI/IACET Continuing Education and Training Standard. Their social impact mission includes gathering empirical evidence to empower and support financial wellness initiatives throughout the U.S. and around the world. The Florida Financial Educators Council℠ is a state chapter of the National Financial Educators Council.

Claudia Martins

National Financial Educators Council

+1 702-620-3059

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Florida Financial Literacy Standards and Mandates

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.