National Financial Educators Council Reviews California's Proposed Financial Literacy Standards and Mandates

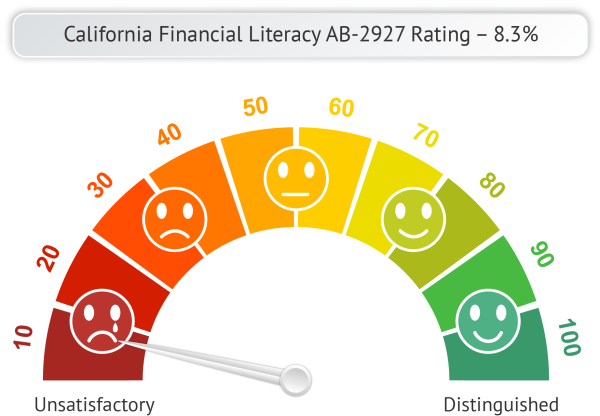

NFEC's rating of California's proposed financial literacy standards.

LOS ANGELES, CALIFORNIA, UNITED STATES, July 10, 2024 /EINPresswire.com/ -- Legislation in California, AB-2927 calls for personal finance instruction for students in the state’s high schools. According to the National Financial Educators Council (NFEC), AB-2927 introduced by Assemblymember Kevin McCarty, falls short of meeting minimum education standards and does not prepare youth for near-term financial decisions. The NFEC gives the bill an overall rating of 8.3% out of 100.

“Although well-intentioned, the bill fails to meet educational standards that would ensure optimal student outcomes from the coursework,” according to Vince Shorb, CEO of the NFEC. “The proposed legislation falls short of the rigorous educational standards to which other subjects are held and shows a lack of pedagogical depth.”

The National Financial Educators Council rated California AB-2927 across 12 different areas. These areas outline minimum education standards of other core high school level topics yet are absent in most financial literacy standards and mandates. Following are the 12 categories across which the NFEC rates state-level standards for financial education:

Program Structure:

· Delivered in standalone classes and integrated into other subjects.

· Assign adequate time and level of rigor to the subject matter.

· Conduct ongoing education to support long-term outcomes.

Lesson Plans:

· Relevant content that prepares students for financial life events.

· Adopt a proven curriculum that encourages higher-order thinking and application.

· Customize lesson plans based on socio-economic status.

Educators & Leadership:

· Courses led by highly qualified personal finance educators.

· Program development and deployment managed by experienced leaders.

· Learner outcomes focused on long-term financial wellness and early indicators.

Program Support:

· Fund financial literacy programs.

· Encourage parental involvement and provide parents with access to resources.

· Start financial education courses in elementary school.

The NFEC ratings highlight that California’s AB-2927 passed none of the criteria and marginally or conditionally passed 2 of the areas. The bill does require a standalone class for financial literacy, but does not mention the inclusion of the topic into other areas. The other area conditionally passed is the state does have a funding mandate to schools.

“The California State Legislature and supporters are not helping to foster financial well-being among the youth of California states Larry Dicke, retired Chief Financial Officer of the California Chamber of Commerce. The effectiveness of this legislation would be significantly enhanced by adding a requirement to meet the minimum education standards for other core subjects taught in CA high schools.”

To help address the concerns raised, the National Financial Educators Council (NFEC) has developed a set of benchmarks for financial education at all grade levels, K-12. Policymakers can consult a guide – the “Policy and Standards Framework for High School Financial Education” – to help craft legislation that ensures the educational quality and learner outcomes to provide California youth with the best possible financial wellness education.

The NFEC’s Policy & Standards Framework for High School Financial Literacy Education establishes two core objectives:

1) Elevate financial education mandates to meet standards of other core subjects;

2) Prepare every high school graduate to make near-term financial decisions.

“When we fail to hold financial literacy to high standards, it’s our youth who suffer,” comments Vince Shorb, the NFEC’s CEO. California’s proposed financial literacy bill fails to meet even the basic educational standards applied to other subjects. Students will not graduate capable of making near-term financial decisions and may suffer the fate of most youth who find themselves struggling for financial independence.”

As an IACET Accredited provider, the National Financial Educators Council® offers IACET CEUs for its learning events that comply with the ANSI/IACET Continuing Education and Training Standard. Their social impact mission includes gathering empirical evidence to empower and support financial wellness initiatives throughout the U.S. and around the world. The California Financial Educators Council℠ is a state chapter of the National Financial Educators Council.

Claudia Martins

National Financial Educators Council

7143966454 ext.

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Review of California's proposed financial literacy standards.

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.