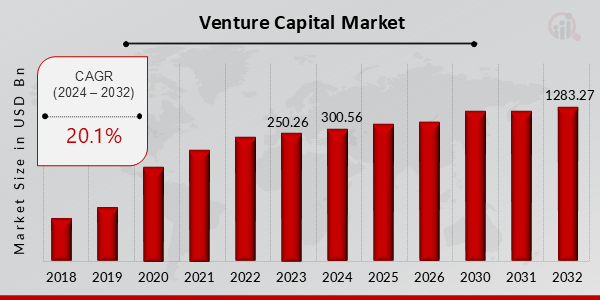

Venture Capital Market Projected for 20.1% CAGR, Reaching $1283.27 Billion by 2032

Venture Capital Market Growth

Venture Capital Market Research Report By, Investment Stage, Industry, Ticket Size, Investor Type, Deal Structure, Regional

RI, UNITED STATES, March 25, 2025 /EINPresswire.com/ -- The global Venture Capital market has witnessed substantial growth in recent years and is expected to expand significantly in the coming decade. The market size was estimated at USD 250.26 billion in 2023 and is projected to grow from USD 300.56 billion in 2024 to an impressive USD 1283.27 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 20.1% during the forecast period (2024–2032). The growth is primarily driven by increasing startup investments, technological advancements, and rising investor interest in high-growth sectors.

Key Drivers Of Market Growth

Increasing Startup Investments The growing number of startups across various industries, including technology, healthcare, and fintech, is fueling demand for venture capital funding.

Technological Advancements Innovations in artificial intelligence, blockchain, and biotech are attracting venture capital investments, accelerating market growth.

Rising Investor Interest in High-Growth Sectors Investors are increasingly focusing on high-growth industries such as e-commerce, SaaS, and clean energy, driving venture capital inflows.

Government Support and Policies Favorable regulations and government initiatives promoting entrepreneurship are further boosting the venture capital ecosystem.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/24699

Key Companies in the Venture Capital Market Include

• Accel Partners

• NEA

• Insight Venture Partners

• Matrix Partners

• Redpoint Ventures

• Lightspeed Venture Partners

• Andreessen Horowitz

• SoftBank Vision Fund

• Kleiner Perkins Caufield Byers

• Tiger Global Management

• Index Ventures

• Union Square Ventures

• Bessemer Venture Partners

• Battery Ventures

• Sequoia Capital

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/venture-capital-market-24699

Market Segmentation To provide a comprehensive analysis, the Venture Capital market is segmented based on funding stage, industry vertical, investment model, and region.

1. By Funding Stage

• Seed Funding: Initial capital for startups to develop their business model.

• Early-Stage Funding: Investment in startups with validated business models and early revenue.

• Growth-Stage Funding: Capital infusion for scaling operations and expanding market reach.

• Late-Stage Funding: Funding for mature startups preparing for acquisition or IPO.

2. By Industry Vertical

• Technology: Software, AI, and blockchain-focused investments.

• Healthcare & Biotech: Funding for pharmaceutical, biotech, and healthcare startups.

• Fintech: Investments in digital banking, payments, and blockchain-based financial solutions.

• Consumer Goods & Retail: E-commerce and direct-to-consumer brands attracting venture capital.

• Clean Energy & Sustainability: Increasing focus on green energy and ESG investments.

3. By Investment Model

• Direct Investments: Venture capital firms directly funding startups.

• Fund-of-Funds: Investments made through venture capital funds.

• Corporate Venture Capital: Large corporations investing in startups to drive innovation.

4. By Region

• North America: Dominant market with a high concentration of venture capital firms and startups.

• Europe: Growing investment landscape driven by fintech and biotech sectors.

• Asia-Pacific: Fastest-growing region, fueled by rapid digitalization and government-backed startup initiatives.

• Rest of the World (RoW): Steady growth expected in Latin America, the Middle East, and Africa due to increasing entrepreneurial activity.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=24699

The global Venture Capital market is poised for exponential growth, driven by the surge in startup activity, technological disruptions, and investor appetite for high-growth sectors. As venture capital firms continue to deploy funds across various industries and regions, the market is set to play a critical role in shaping the future of entrepreneurship and innovation.

Related Report:

Online Payment Gateway Market-

https://www.marketresearchfuture.com/reports/online-payment-gateway-market-6347

Blockchain in Fintech Market-

https://www.marketresearchfuture.com/reports/blockchain-fintech-market-6368

BFSI Security Market -

https://www.marketresearchfuture.com/reports/bfsi-security-market-1810

Core Banking Solution Market -

https://www.marketresearchfuture.com/reports/core-banking-solutions-market-32

Financial Cloud Market -

https://www.marketresearchfuture.com/reports/financial-cloud-market-7492

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release