The Sustainability Dividend: A Primer on Sustainability ROI

As sustainability becomes a business imperative, companies face growing pressure to determine the return on investment (ROI) of their sustainability efforts, a critical factor in gaining stakeholder trust and ensuring long-term success. This report highlights insights from a series of Member roundtables and polls, discusses the current state of sustainability ROI, and provides guidance for companies to get started.

Key Insights

- Sustainability ROI extends beyond short-term financial gains by capturing long-term financial, environmental, and social value.

- Discussions on the value of sustainability will continue, making it essential for companies to measure sustainability ROI.

- Accurately measuring sustainability ROI can be challenging: corporate sustainability teams should start the process by aligning their language with that of the corporate finance function.

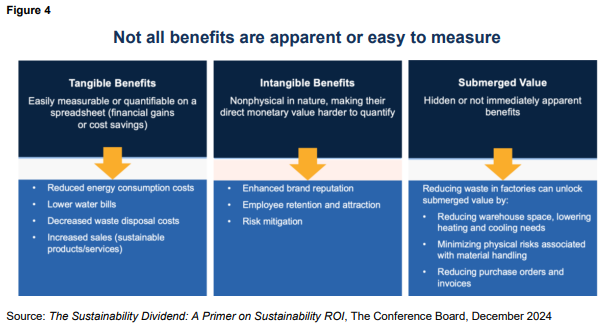

- To fully capture sustainability ROI, companies should account for both tangible (easily quantifiable) and intangible (nonphysical, with harder-to-quantify monetary value) benefits, including those that may not be immediately obvious (hidden benefits).

- Few companies are capitalizing on the power of authentic and transparent sustainability communication to showcase their sustainability results and gain internal and stakeholder support for sustainability.

Understanding Sustainability ROI

- Unlike traditional ROI, which mostly emphasizes investments’ short-term financial returns, sustainability ROI adopts a longer-term view, measuring financial, environmental, and social value. Its complexity lies in the multidimensional nature of sustainability and in factoring in intangible benefits, among other factors. To assess it accurately, companies should first unpack the concept, ensuring that all relevant elements are considered for a comprehensive evaluation.

|

Sustainability encompasses the full range of initiatives designed to promote the longterm welfare of a company, its multiple stakeholders, society at large, and the environment. It includes efforts to ensure compliance with sustainability-related laws and regulations, including disclosure requirements.

The ROI of sustainability reflects the measurable benefits derived from corporate sustainable practices, including economic, environmental, and social gains. While the approach to defining and calculating ROI in sustainability differs across companies, the common goal is to evaluate the full value (i.e., the overall worth or benefit) generated from these investments. |

Sustainability ROI differs from traditional ROI, [1] which emphasizes measurable, short-term returns tied to monetary gains, by adopting a longer-term view and factoring in broader environmental, social & governance (ESG) outcomes. Moreover, sustainability ROI is more difficult to measure than traditional ROI due to its multidimensional nature and intangible benefits that are not physical in nature. For instance, a company reducing plastic use may lower costs over the longer term, gain customer trust, and enhance its brand image, creating long-term value beyond just financial savings.

Sustainability ROI definitions and approaches can vary depending on the company, initiative, and sector. For example, a manufacturing company might reduce costs by improving energy efficiency and waste reduction, while a retail business could enhance its brand reputation by prioritizing ethical sourcing and reducing carbon emissions. Both approaches contribute to sustainability ROI, but the value created may vary. Some factors, like energy costs, can be easily quantified, whereas others, such as positive brand association, might be more challenging to calculate and attribute.

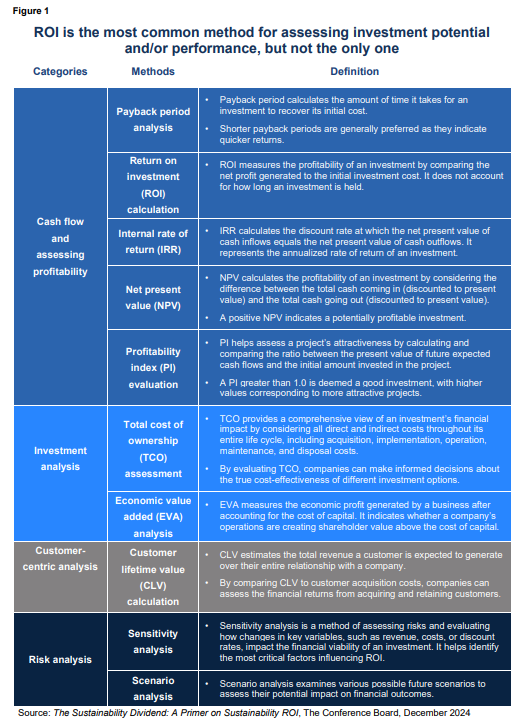

Of the 32 executives polled during the May 2024 session of the ROI of Sustainability roundtable series, 59% said they use ROI calculation to assess the profitability or efficiency of investments within their organization. But as shown in Figure 1, ROI calculation is just one of many possible methods.

As sustainability becomes more integrated across the organization, directly attributing a payback—such as financial returns or cost savings from sustainable initiatives—can be complex. Therefore, before calculating sustainability ROI, companies should clearly define their scope and objectives and unpack the concept by examining the entire value chain, not just internal operations. This means breaking down tangible costs such as energy, waste, and resource use, as well as intangible factors such as brand reputation, employee satisfaction, and the ability to attract top talent.

Why Is Sustainability ROI Important?

- The discussion about sustainability “value” will persist in the coming years as economic uncertainty grows and resources face more scrutiny to ensure they are allocated to address current challenges and build resilience. Today, 41% of polled executives believe their companies are underperforming or are uncertain about assessing the ROI of sustainability investments. To stay competitive, businesses should focus on reliably determining sustainability ROI.

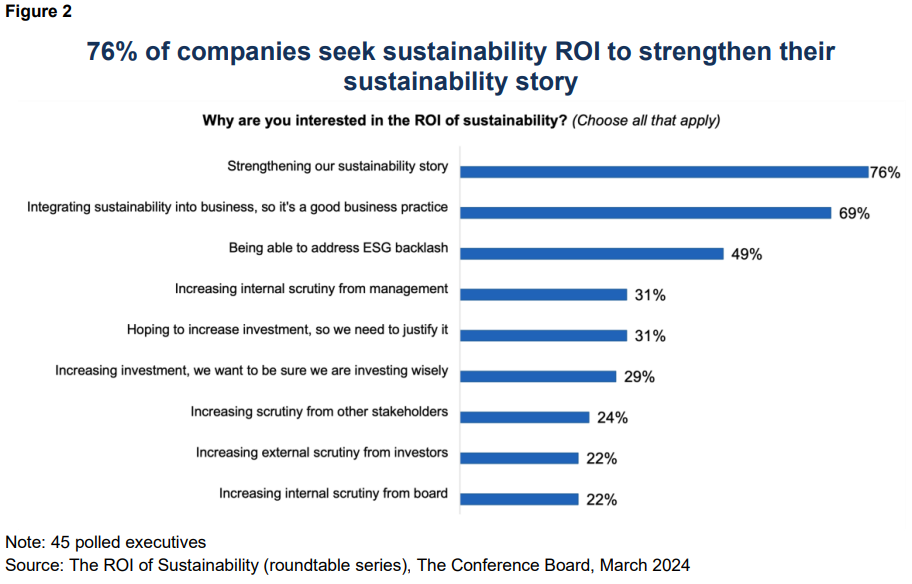

Sustainability ROI brings rigor to evaluating a company’s sustainability efforts by quantifying their impacts in financial terms. It has become a business imperative to show investors and other stakeholders that sustainability is a component of corporate strategy and contributes to the long-term success of a company, while also securing buy-in from internal decision-makers such as the chief financial officer (CFO), the CEO, and the board of directors. According to a poll from The Conference Board, measuring sustainability ROI is especially important for strengthening a company’s sustainability story and further integrating sustainability into the business (Figure 2).

Despite its importance, determining the ROI of sustainability initiatives remains a nascent practice. Data from The Conference Board show that 41% of polled executives either believe their companies are underperforming or are uncertain when it comes to assessing the ROI of their sustainability investments, while only 17% express similar concerns about measuring traditional ROI.

Amid global challenges such as economic uncertainty, which pressures businesses to invest strategically for cost savings and risk mitigation, and climate change and resource scarcity, which require investments to adapt and respond, companies will need to prioritize assessing the financial returns of their sustainability initiatives.

That said, companies should also keep in mind that not every initiative may need to demonstrate an ROI: modern businesses are evolving beyond purely financial metrics; many companies are required to devote resources to complying with sustainability-related reporting and other requirements; and some corporate efforts—such as philanthropy—prioritize generating positive societal or environmental impact over achieving financial returns.

Building Blocks for Sustainability ROI Success

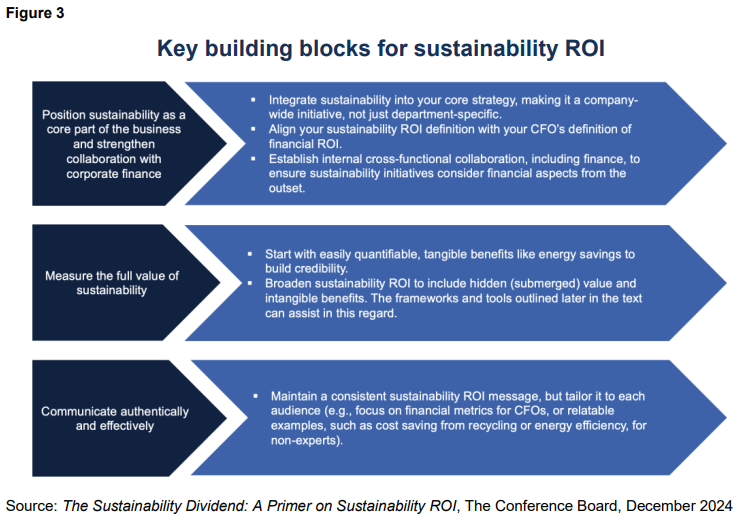

As companies refine their sustainability ROI approaches, they will likely become more adept at quantifying qualitative and hidden benefits. Focusing on key building blocks—such as engaging with corporate finance, valuing intangibles and hidden benefits, and effective communication— supported by continuous learning will help overcome challenges and strengthen internal support. Understanding the challenges in accurately determining sustainability ROI will also enable companies to plan ahead.

When embarking on the sustainability ROI process, companies should consider key factors to ensure the effectiveness of the approach, beginning with aligning their definition of ROI with that of their CFO. Figure 3 provides a summary of these building blocks, which are explained in greater details in the next sections.

Working Closely with Corporate Finance

- To maximize sustainability ROI, companies should embed sustainability into their core strategy and align it with the CFO’s financial ROI definition to prevent missed opportunities in decision-making and ensure long-term value creation. This is crucial because many leaders still see sustainability as separate from the core business strategy. Bridging this gap requires stronger collaboration between finance and sustainability functions and cross-functional collaboration throughout the company.

To be successful in their sustainability ROI efforts, companies should frame sustainability as a corporate-wide strategic effort to ensure it is not seen as an isolated initiative from a particular department but as a fundamental part of the company’s overall strategy. This is important because linking sustainability to the core business is frequently overlooked, [2] and failing to integrate sustainability into key areas such as strategy, budgeting, and forecasting can lead to missed opportunities in decision-making, risk management, innovation, and competitiveness.

A critical step for this integration is strengthening the connection between sustainability and finance to ensure sustainable practices support long-term business success. As such, aligning sustainability ROI with the CFO’s definition of financial ROI is essential to enable effective communication of sustainability ROI to the CFO and ensure consistent and informed decisionmaking across the organization. Strengthening collaboration between the sustainability and finance functions from the outset is also crucial, as these departments often face communication challenges due to differing priorities and terminology.

To bridge this gap, companies could consider the following initiatives:

- Training finance and sustainability experts to understand each other’s roles and perspectives.

- Embedding finance professionals within sustainability teams as liaisons to ensure financial considerations are included early.

- Creating shared roles that report to both the CFO and chief sustainability officer (CSO) to promote cross-departmental collaboration.

- Appointing ESG controllers to oversee the integration of ESG factors into operations and financial reporting and to liaise with third-party sustainability assurance providers.

- Tying key executive officer remuneration to sustainability targets and tracking performance through specific key performance indicators (KPIs).

- Joining initiatives like Accounting for Sustainability (A4S), which equips finance leaders with tools, guides, and strategies to integrate sustainability into financial decision-making.

Companies should also establish or leverage their existing cross-functional collaboration mechanisms (e.g., steering committees) to actively engage all relevant teams in the sustainability ROI process and ensure sustainability is integrated as a core business initiative.

Measuring the Full Value of Sustainability

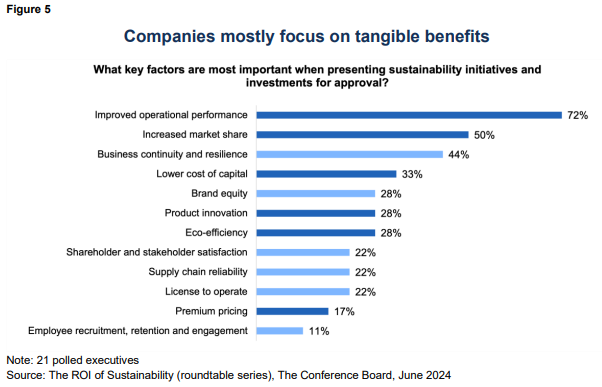

- When measuring sustainability ROI, companies tend to focus on tangible and easier-tomeasure benefits, paying less attention to the intangible benefits and submerged value that can significantly enhance overall financial performance. A poll of executives shows that when organizations are approving sustainability initiatives, operational performance and improved market share (tangible benefits) are top priorities, with factors like employee recruitment, retention, and engagement (intangible benefits) receiving far less attention. Organizations should evaluate the entire spectrum of benefits to fully realize the potential of their sustainability efforts.

Measuring sustainability ROI for specific, straightforward projects such as installing energy-efficient lighting in a warehouse is relatively simple: energy savings can be tracked through reduced utility costs, while environmental benefits, such as reduced carbon emissions, can be calculated based on energy consumption data. However, it becomes more complex when sustainability is integrated into broader strategies or projects that involve harder-to-quantify impacts, such as brand reputation or other intangible benefits. Companies can assess these intangibles using indirect metrics, such as increased customer loyalty and enhanced employee engagement, though these may not immediately translate into financial returns.

Moreover, a significant portion of the value generated from sustainability efforts is submerged, representing hidden benefits that are not immediately apparent (see examples in Figure 4). As a result, companies frequently assign these benefits little to no value.

Independent research indicates that intangible benefits constitute the majority of a company’s overall value, [3] and one organization that specializes in helping businesses quantify value notes that for its clients, “the norm is for submerged value to be worth 4-10 times as much as visible value.” [4]

Despite this, data from The Conference Board reveal that when presenting sustainability initiatives and investments for approval by leadership, executives mostly focus on immediate, tangible benefits, such as improved operational performance or increased market share, rather than intangible benefits such as brand equity or employee recruitment, retention, and engagement (Figure 5).

To broaden the view of what constitutes value, companies should raise leadership awareness of the critical role intangible and hidden benefits play since these are essential to enhancing the financial impact of sustainability initiatives. To support this effort, they should leverage established frameworks and tools to factor in intangible benefits and submerged value (see examples below).

Examples of Frameworks and Tools for Measuring Sustainability ROI, Including Intangibles and Submerged Value

|

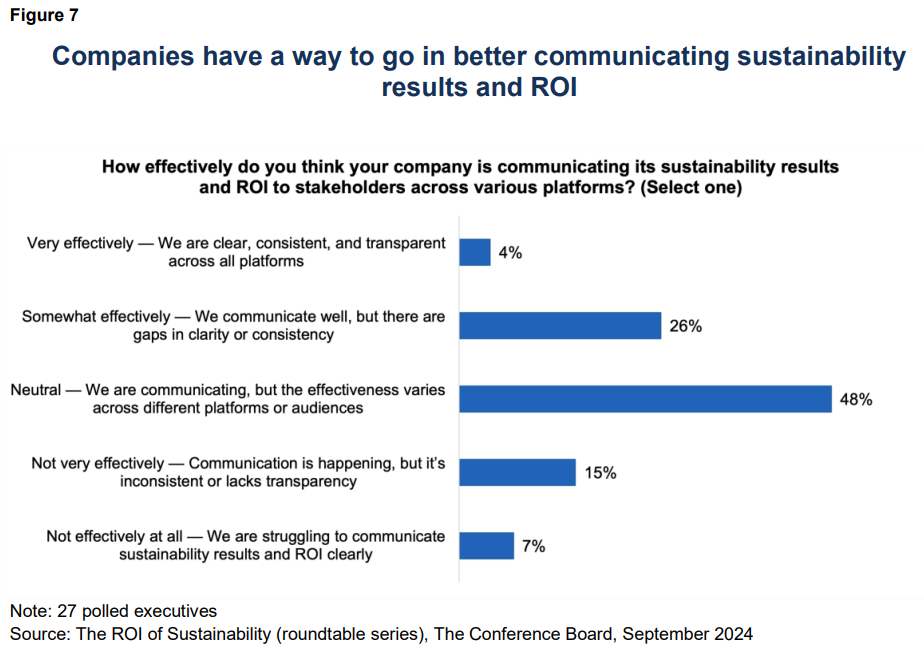

Communicating Authentically and Effectively

- Companies that communicate effectively with authenticity will unlock financial value and gain stronger internal support. Less than one-third of polled executives believe their company effectively communicates its sustainability results, while nearly one-quarter consider their communication ineffective. To make progress, companies should tailor sustainability communications to their different audiences, ensure accurate reporting, and align messaging with evolving business goals, stakeholder priorities, and regulations.

Communicating sustainability authentically and effectively [5] is crucial for unlocking financial value. Independent research shows that top global brands are losing billions in potential value by not effectively communicating their sustainability achievements and progress. [6]

Moreover, a majority of executives (82%) polled by The Conference Board report that their main motivation for communicating the ROI of sustainability is to secure internal alignment and financial support (Figure 6).

However, 30% of surveyed executives say their company effectively communicates its sustainability results and ROI to stakeholders, and 22% consider their company’s sustainability communication to be ineffective, rating it from “not very effective” to “not effective at all” (Figure 7).

To get their message across effectively, companies should tailor their communications to meet stakeholders where they are. This requires identifying key stakeholders (e.g., investors, employees, customers) and analyzing the information or metrics these stakeholders need to make informed decisions. Also, while maintaining a clear, consistent, and fact-based message, companies should adjust its presentation to match their audience’s specific interests and understanding. For example, a CFO or financial analyst may focus on financial metrics, while employees with limited sustainability expertise may better grasp concepts that are memorable and relatable like cost savings or recycled material usage.

Furthermore, accurate reporting is essential, as failure to do so can result in billions in lost value, for example by damaging brand perception through greenwashing or greenhushing. Thus, companies might want to set SMART (specific, measurable, achievable, relevant, and timely) goals, as these help enhance credibility and track progress. They should also conduct regular audits and reviews of sustainability messaging to ensure alignment with evolving business objectives, stakeholder priorities, regulations, and other influencing factors.

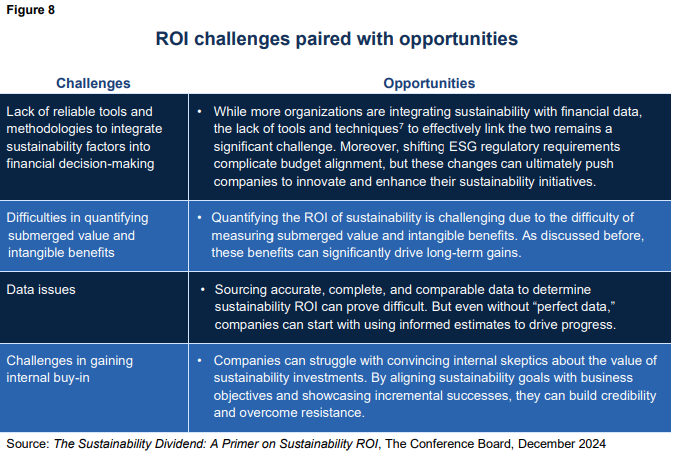

Addressing common challenges

While considering the abovementioned building blocks, companies should also anticipate the challenges associated with measuring sustainability ROI to ensure effective preparation. These challenges include methodological limitations, data-related issues, and the need for broader internal support. They also present valuable opportunities, as highlighted in Figure 8.

Conclusion

Determining sustainability ROI is crucial for demonstrating long-term business value and securing internal support. As a start, recognizing sustainability ROI challenges and key building blocks—beginning with aligning finance and sustainability teams on a shared understanding— will enable companies to more effectively assess sustainability ROI. Considering the full spectrum of benefits (e.g., tangible, intangible, and hidden benefits) and using effective communication will also help businesses unlock the hidden (or submerged) value of sustainability, increase internal buy-in, and enhance overall financial performance.

This article is based on corporate disclosure data from The Conference Board Benchmarking platform, powered by ESGAUGE. Visit conferenceboard.esgauge.

1The traditional ROI measures the profitability of an investment by comparing the net profit generated to the initial investment cost (see Figure 1).(go back)

2A 2024 survey by The Conference Board involving 104 sustainability executives shows that fewer than one-third of the companies surveyed are at an advanced stage of fully implementing sustainability strategy across their organization.(go back)

3Ocean Tomo, Intangible Asset Market Value Study, September 2020.(go back)

4Daniel Aronson, The Only Value Sustainability Can’t Possibly Have, Sustainable Brands, February 12, 2024.(go back)

5As noted by The Conference Board, a story is authentic when it genuinely represents a company’s business, culture, and ambitions. It is effective when it meets the needs of both the storyteller and the audience.(go back)

6Brand Finance Sustainability Perceptions Index 2024, March 2024.(go back)

7Based on a survey of over 100 senior finance professionals, the A4S Finance Leaders’ Sustainability Barometer 2024 reveals that despite recognizing the importance of sustainability, more than a quarter of respondents still lack reliable tools to incorporate it into financial decision-making.(go back)

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release