TikTok’s Identity Crisis: Corporate Personality in a De-Globalizing World

Introduction

TikTok’s travails under the Trump and Biden Administrations are typically portrayed as a clash between national security interests and First Amendment protections. This tension is the focus of TikTok’s suit against the U.S. Government over a 2024 law that subjects the video platform to a ban in the United States unless it is divested from Chinese control by January 19, 2025.

But TikTok’s problems in the United States expose another serious tension: between longstanding legal doctrines of corporate identity and separate personality, on one hand, and increasing concerns over Beijing’s use of erstwhile private commercial firms as instruments of state influence, on the other. The divest-or-ban legislation illustrates that corporate law’s answers to the question of corporate identity and separateness are not definitive in a de-globalizing world.

Corporate Identity and Personality

What determines the identity of a corporation? Corporate law has straightforward answers. Under the internal affairs doctrine followed in the United States, the identity of a corporation is determined by its jurisdiction of incorporation. In the traditional test followed in continental Europe, the real seat doctrine asks where a company’s “center of management and control” resides – focusing on the place where day-to-day management decisions are made. An important corollary of these principles is the doctrine of separate corporate personality – barring unusual circumstances, a corporation is deemed to have a separate existence from that of its shareholders, including its corporate parent.

These doctrines have withstood the test of time, suggesting that despite the inevitable weaknesses of any bright line test, they provide workable choice-of-law rules with which to resolve internal governance issues and to establish the basis by which assets are partitioned between a corporation and its investors.

But corporate law’s standard identity and personality tests are proving far less helpful in addressing the national security challenges posed by corporate activity in a global – but rapidly de-globalizing – world, particularly one in which data is the coin of the realm.

Consider TikTok’s identity crisis.

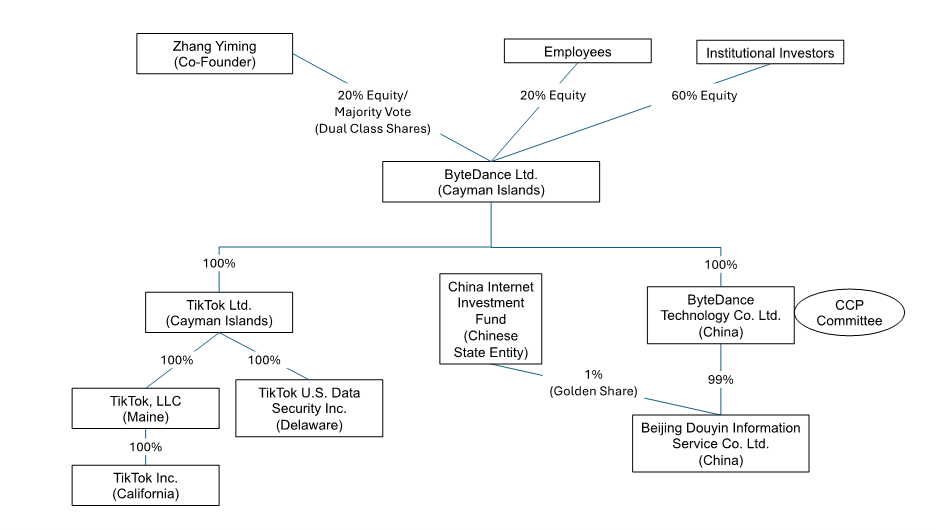

TikTok’s Ownership Structure

(based on publicly available information)

TikTok, the short video streaming platform with 170 million U.S. users, is operated by TikTok Inc., a California Corporation with headquarters in Culver City, California. The parent of TikTok Inc. (via an intermediary LLC), overseeing TikTok’s global operations, is TikTok Ltd., which is incorporated in the Cayman Islands. Its parent, ByteDance Ltd., is also incorporated in the Cayman Islands. ByteDance Ltd. is controlled by one of its co-founders, Zhang Yiming, via dual class shares reportedly giving him majority voting control, notwithstanding his 20% equity stake. Sixty percent of the equity is held by global institutional investors, including Sequoia and KKR. Employees hold the remaining 20% of the equity. While ByteDance Ltd.’s headquarters are in Beijing, a majority of its board members are non-Chinese nationals, including multiple representatives of its U.S.-based institutional investors. None of its directors reside in China.

Neither TikTok Ltd. nor TikTok Inc. operates in China, and none of their senior executives are Chinese nationals. The company’s executives operate out of Singapore and Los Angeles. Data generated by the platform’s users is stored in the United States, Singapore, and Malaysia. A subsidiary of TikTok Ltd., Delaware incorporated TTUSDS, was created to limit ByteDance’s access to the data of TikTok’s U.S. users and to monitor security of the platform.

Thus far, nothing about TikTok is Chinese, apart from the nationality of the (human) controlling shareholder of its ultimate parent company, which is immaterial under corporate law’s standard personality tests. From this perspective, it is plainly inaccurate to call the TikTok entities or the video platform they operate “Chinese.”

But here’s where the question of corporate identity gets complicated in a world rife with geopolitical tensions between the United States and China – and a Chinese political economy that increasingly blurs the boundary between commercial enterprises and instruments of the party-state.

ByteDance Ltd., at the top of the TikTok ownership chain, also wholly owns ByteDance Technology Co., Ltd., a China-incorporated company in charge of the group’s Chinese domestic operations. This corporate sibling of TikTok maintains an internal Chinese Communist Party (CCP) committee, as long required by China’s Company Law (see Article 18). This feature of Chinese corporate law – requiring an organization representing a political party within the corporation – has no counterpart anywhere in the world, not even in Russian state-owned enterprises. Exactly what the internal CCP committee of ByteDance, or any other Chinese firm, does is a matter of speculation, because neither the Company Law nor any other regulation explicitly specifies the role of such committees – although Article 33 of the Chinese Communist Party Constitution provides that in private companies, the Party committee “shall implement the Party’s principles and policies.”

Most Chinese companies, ByteDance included, say little publicly about the membership or function of their internal CCP committees. While it is unlikely that these committees routinely intervene in corporate strategy or operations, they are plainly a channel of potential political influence in Chinese commercial enterprises, ensuring that management remains friendly toward the Party and government. And research shows that some private firms cede substantive governance roles to these committees. The very existence of these committees raises fundamental questions about whether corporate law’s standard personality tests are appropriate for Chinese companies where the question of Beijing’s influence is concerned.

ByteDance Technology Ltd.’s wholly owned subsidiary is Beijing Douyin Information Services Co., Ltd., which operates Douyin, a short video streaming platform for the Chinese market. (TikTok is not allowed in China and Douyin does not contain most of the videos available on TikTok.) Douyin is ByteDance’s crown jewel, generating the bulk of its China revenues, which account for roughly 80% of ByteDance’s total revenues. Via an intermediary, a state investment organ called China Internet Investment Fund (CIIF) holds a 1% stake in Beijing Douyin. This is a golden (or “special management”) share, giving a representative of China’s Cyberspace Administration a board seat and editorial influence over Douyin’s content. Similar special management shares have been taken by organs of the Chinese state in many data-rich companies, particularly ones that provide content subject to China’s strict censorship regime.

The TikTok and Douyin platforms are designed for different markets and operated by legally separate entities. Yet it is hard for Western policy makers to ignore their common lineage and the reality that TikTok’s corporate siblings are connected to the Chinese party-state via share ownership, board representation, and an internal organization representing the CCP.

An additional concern is China’s National Intelligence Law, which provides in Article 7 that all Chinese “organizations and citizens shall support, assist and cooperate with national intelligence efforts…” While the law likely does not apply to a foreign incorporated subsidiary ultimately controlled by a Chinese citizen, such as TikTok Inc., it is unrealistic to expect that Zhang Yiming or other senior Chinese corporate leaders of ByteDance could resist government or CCP orders to influence the TikTok algorithm to the detriment of U.S. national security interests, or to seek access to the data generated by its American users for Chinese intelligence purposes.

The reality is that TikTok’s relationship with China and its susceptibility to Chinese party-state influence operate through channels that venerable doctrines on corporate identity and separate personality do not fully recognize. As a result, it is not surprising that policymakers in the United States and Europe have viewed TikTok’s Western persona with a great deal of skepticism. They see TikTok as a potential instrument of malign Chinese state influence – a conclusion that led the U.S. Congress in 2024 to pass The Protecting Americans from Foreign Adversary Controlled Applications Act (Public Law 118-50, Division H; the “Applications Act”). The Applications Act requires the TikTok platform to be divested from “foreign adversary control” by January 19, 2025 (subject to a 90-day extension by the President) or effectively be banned from operation in the United States.

The policymakers’ concerns over TikTok are seemingly at odds with the law’s standard tests of corporate identity and separate personality: the legislation is not seeking to pierce the corporate veil by treating TikTok as the alter ego of ByteDance and its controlling shareholder. Rather, the law effectively treats TikTok as the alter ego of the Chinese government and CCP. Whether justified or an overreaction, this approach reflects a more wholistic view of China’s “hybrid commercial threat” in the global economy than one framed entirely by standard corporate law and governance metrics. The D.C. Circuit Court of Appeals (at p. 27) explicitly notes that the U.S. government was not asking the Court to apply standard exceptions to fundamental principles of corporate separateness, but to recognize the “risk of a foreign adversary exploiting [the] corporate form.”

Corporate Identity and National Security

The TikTok episode exposes a new reality: Contrary to widespread predictions that globalization would lead to the statelessness of large corporations, weaponized interdependence has heightened the salience of questions about corporate identity and control, as well as informal channels of state influence over commercial enterprises. TikTok’s identity crisis reveals the limitations of standard corporate law doctrines in satisfying policymakers focused on national security and geopolitical rivalry.

The Applications Act, requiring divestiture of applications under the control of a “foreign adversary” (statutorily defined as China, Russia, North Korea and Iran), illustrates how fundamental corporate law principles can be sidestepped by approaches that effectively disregard established doctrines of corporate identity and separate personality, in view of perceived national security imperatives. Broader tests of corporate identity may be necessary in these circumstances because more than ever, state influence over commercial actors operates through control over capital and data flows, market access, supply chain vulnerabilities, and other forms of geo-economic leverage.

Yet, if blunt tests of “adversary control” over a corporation such as that used in the Applications Act (see Section 2(g)(1)) are to be avoided in favor of more surgical approaches to corporate identity that facilitate continued global economic interaction, more nuanced frameworks for determining corporate identity and de facto state influence/allegiance may need to be developed. This is a tall order.

Until the current de-risking and friendshoring trends are reversed, we can expect more episodes that expose the limitations of traditional corporate identity and personality tests in a de-globalizing world.

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release