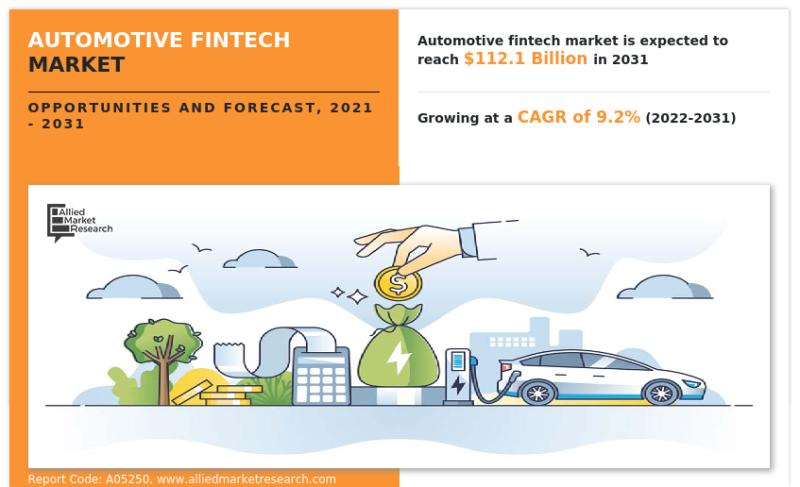

Automotive Fintech Market to Double by 2031, Reaching $112.1 Billion with a CAGR of 9.2%

Automotive Fintech Market Size

Collaboration with fintech, automotive digitalization, usage-based fintech demand, and blockchain adoption drive the global automotive fintech market.

WILMINGTON, DE, UNITED STATES, November 29, 2024 /EINPresswire.com/ -- According to the report published by Allied Market Research, the global automotive fintech market size generated $47.1 billion in 2021, and is estimated to reach $112.1 billion by 2031, witnessing a CAGR of 9.2% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players, new entrants, investors, and stakeholders in devising strategies for the future and taking steps to strengthen their position in the market.

Download Sample Report (Get Full Insights in PDF - 297 Pages) at: https://www.alliedmarketresearch.com/request-sample/5615

Automotive fintech refers to the integration of financial technology (fintech) solutions within the automotive industry. It involves the use of digital platforms, apps, and technologies to streamline financial services such as vehicle financing, leasing, insurance, payments, and even blockchain-based transactions for buying and selling cars. This sector leverages innovations like digital wallets, peer-to-peer lending, and telematics data to enhance customer experiences, improve vehicle financing processes, and offer new financial products tailored to automotive needs.

North America currently dominated the global automotive fintech market in 2021. There is rapid growth in fintech technologies has coincided with a Fintech applications and online websites that have made obtaining auto loans and insurance an easy process. Moreover, it is predicted, there may be an increase in the demand for vehicle loans in U.S. during the forecast period as a result of variables including the growth of transportation-related industrialization activities and the rise in the number of consumers asking for auto loans. Many vehicle dealers, brokers, or even showrooms may present an auto loan scheme to customers that visit their locations. These initiatives are intended to help individuals pay a percentage of the value of the car upfront rather than making monthly payments, which is projected to promote consumer confidence. Fintech in the automobile industry has been carried out across the region as a result of an increase in number of automobiles and changing consumer behavior, which leads to the expansion of the automotive fintech market in this region.

Key players operating in the automotive fintech market include The Savings Group, Inc., AutoFi Inc., Blinker, Inc., By Miles Ltd., Creditas Soluções Financeiras, Cuvva, Grab, ROUTEONE, Euroclear, Kuwy Technology Service Private Limited.

Buy Now & Get Up to 50% off on This Report: https://www.alliedmarketresearch.com/automotive-fintech-market/purchase-options

A rise in development in the automotive fintech sector across the region is projected to drive market expansion. In the insurance industry, for example, digitizing insurance and claim processing might help insurers eliminate fake claims, shorten processing times by 80%, and reduce settlement overhead costs by 90%. Automotive manufacturers may narrow the technology gap and thereby improve customer experience with the help of additional customer touch points given by fintech collaborations. Furthermore, the automotive fintech market is expected to represent the future of the automotive sector, supporting market participants in increasing revenue margins and keeping customers.

Security and privacy are major concerns in the market. Automobiles are prone to hacking and theft due to connected technologies such as telematics, GPS, and remote start systems. Automotive fintech companies must implement encryption and firewalls to combat this. Moreover, data security is also an issue as significant amounts of personal and sensitive information are collected and stored. Businesses must use encryption, secure storage and access controls, and regular data audits to prevent data breaches. In terms of payment security, digital payments are subject to fraud and theft. Businesses must implement secure payment systems that include multi-factor authentication, encryption, and fraud detection to mitigate these concerns. Addressing these security and privacy problems would increase the cost of fintech services which limit the expansion of the automotive fintech market.

However, the adoption of blockchain technology presents a significant opportunity for innovation in the automotive fintech industry. It can be used to safely and transparently store and manage loan information, reducing the risk of fraud and errors and increasing the efficiency of the loan application and approval process overall. Furthermore, blockchain technology has the potential to improve loan transaction transparency and security, allowing clients to better understand and manage their loan terms and conditions. This can help to build consumer trust and credibility, as well as boost customer satisfaction. In addition, the decentralized nature of blockchain technology may provide clients with more control over their personal loan information, further strengthening the security and privacy of their financial data. Automotive fintech companies can use blockchain technology to accelerate growth, increase competitiveness, and ultimately benefit their consumers.

If you have any special requirements, Request customization: https://www.alliedmarketresearch.com/request-for-customization/5615

Moreover, blockchain technology is increasingly being used for the secure tracking of car ownership and maintenance information, as well as online loan applications and digital insurance products. For instance, in October 2020, FinTech Auto1 FT released Europe's first blockchain-based auto finance based on Ethereum Smart contracts, replacing paper and manual methods. Automotive financing processes and documentation that are faster, more efficient, and safer assist the mobility business. This significant step towards total vehicle digital mapping will propel the market forward. This combination of blockchain technology with automotive fintech solutions creates numerous potentials for the automotive fintech market to expand during the forecast period.

COVID-19 Impact Analysis

The COVID-19 epidemic has had a significant influence on the automotive fintech industry. The market, which was already expanding steadily due to growth in use of technology in the automobile industry, encountered difficulties as the pandemic brought the industry to a halt. This was due to the closure of production plants and showrooms, as well as a decrease in consumer spending. However, the epidemic has accelerated the switch to digital payments and contactless transactions, which has aided automotive fintech startups. Furthermore, the epidemic highlighted the need for financial stability and flexible payment options, resulting in an increase in demand for inventive financing solutions provided by automotive fintech firms.

KEY FINDINGS OF THE STUDY

1. On the basis of end use, In-vehicle payments is anticipated to exhibit significant growth in the near future.

2. On the basis of channel, the subscription segment is anticipated to exhibit significant growth in the near future.

3. On the basis of vehicle type, the commercial vehicle segment is anticipated to exhibit significant growth in the near future.

4. On the basis of region, Asia-Pacific is anticipated to register the highest CAGR during the forecast period.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/5615

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies. This helps us dig out market data that helps us generate accurate research data tables and confirm utmost ata procurement methodology includes deep presented in the reports published by us is extracted through primary interviews with top officials from leading online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: + 1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

help@alliedmarketresearch.com

David Correa

Allied Market Research

+1 800-792-5285

email us here

Visit us on social media:

Facebook

X

Distribution channels: Automotive Industry, Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release