Equity market update

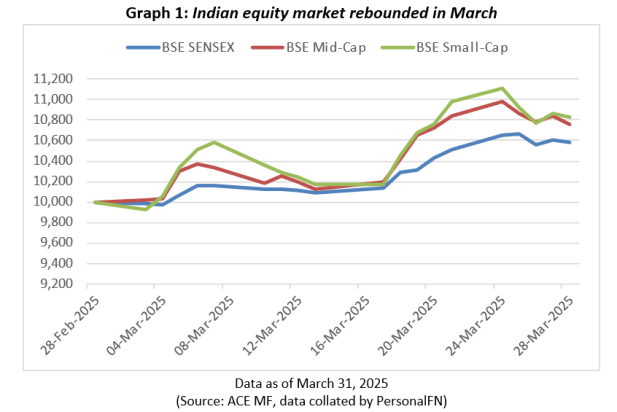

Indian equity markets rebounded in March 2025. The Sensex registered a gain of 5.8%, but underperformed the BSE Midcap and BSE Smallcap index which gained 7.6% and 8.3%, respectively.

India’s GDP growth improved to 6.2% in the December 2024 quarter which is expected to positively impact corporate earnings. Moreover, the likely further rate cuts by RBI will inject more liquidity into the market and lower debt servicing costs. Crude oil too is on the declining trend which is positive for India.

However, uncertainty over reciprocal tariffs by the US and the potential trade wars kept investors cautious.

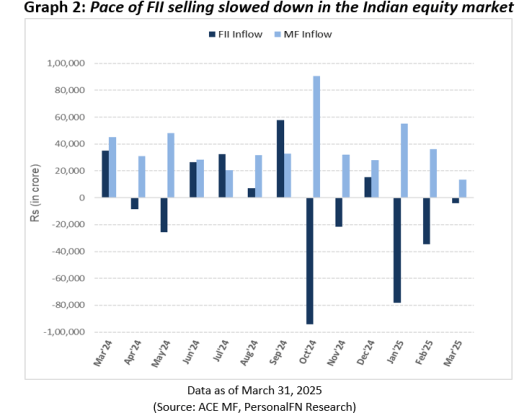

The pace of outflows by foreign investors slowed down substantially, driven by bargain hunting at lower valuations and expectations of economic recovery. In March FIIs net sold equities worth Rs 3,973 crore compared to outflows worth Rs 34,574 crore in February. DIIs continue to be net buyers having bought equities worth Rs 13,458 crore after buying equities worth 36,163 crore in the previous month.

Meanwhile, India’s PMI for manufacturing rose to 58.1 in March 2025, up from 56.3 in February 2025 supported by increased customer interest and favourable demand conditions. During the same period, the PMI for Services moderated slightly to 58.5 in March from 59 in February as domestic and international demand remained strong, though marginally softer sequentially.

Outlook:

The equity market is expected to remain volatile on the back of developments on the tariff front and the potential retaliatory tariffs. However, the near-term noise is unlikely to derail India’s structural growth story.

The overall impact of US tariffs is expected to be considerably lower compared to peers such as China, Vietnam, Taiwan, and Japan, etc. This along with controlled inflation, lower individual tax rates announced in the Union Budget, and fall in crude price are positive for the equity market.

Large-cap stocks are expected to deliver better risk-adjusted returns compared to mid and small caps in the current calendar year as they tend to protect downside risk better. Given the imminent equity market volatility, a prudent asset allocation tailored to your personal risk profile, the envisioned financial goal/s, and the time in hand to achieve those goals will help pave the path for financial success in the long run.

Additionally, a periodic mutual fund portfolio review would also help you assess whether your investments are well-diversified across different asset classes, such as equities, bonds, and other investment avenues.

Debt market update

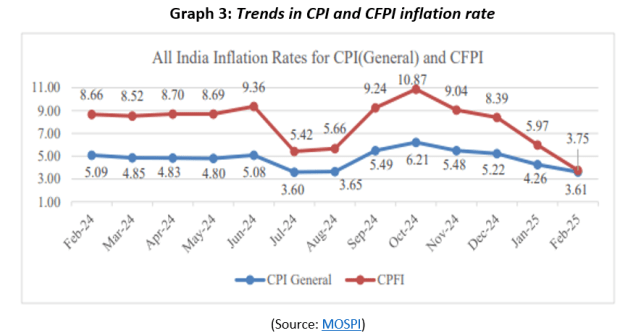

Retail inflation (measured by the Consumer Price Index) eased further to 3.61% in February 2025 compared to 4.26% in January 2025, and 5.09% in February 2024, showed the data released by the National Statistical Office (NSO). With this, CPI inflation continued to be within RBI’s comfort zone of 2-6%, and well below the medium-term target of 4%.

The Consumer Food Price Index (CFPI) also declined sharply to 3.75% in February 2025, compared to 5.97% in January 2025 and 8.66% in February 2024. Vegetable prices softened sequentially as well as y-o-y basis amid seasonal easing of prices.

Fruit inflation, however, surged to a 10-year high of 14.8%, potentially due to increased demand during fasting periods associated with the MahaKumbh, according to SBI Ecowrap report. Imported inflation surged, rising from 1.3% in June 2024 to 31.1% in February 2025, driven by rising prices of precious metals, oils, and fats. While overall inflation moderated, the core inflation crossed the 4.0% mark after 14 months to reach 4.08%.

Outlook:

In a falling interest rate environment, debt mutual funds carrying longer maturity are better positioned to capture attractive gains. But do note that these schemes are suitable for those willing to take some interest rate risk and have medium to long-term investment horizon. Those with a conservative approach can look at schemes carrying shorter maturity period.

For a medium-term investment horizon of 2-3 years or more, Banking & PSU Debt Funds, and Corporate Bond Funds may be suitable avenues, while Gilt Funds may be suitable if the investment horizon is 5 years or more. For those having a shorter investment horizon of 1 to 2 years, investing in the Ultra-Short Duration Funds and Short Duration Funds may be preferable.

On the contrary, for an investment horizon of up to or less than a year, short term debt categories such as Liquid Funds may be suitable.

Gold market update

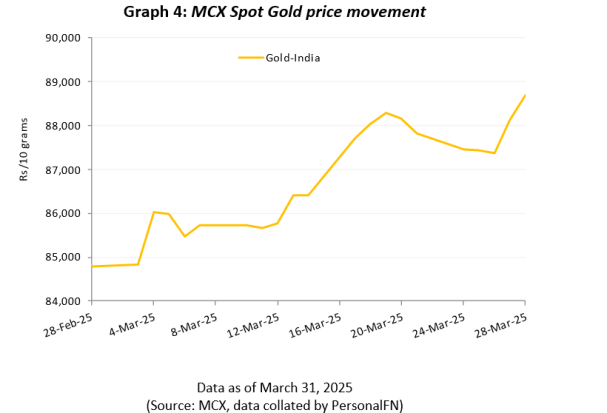

Gold touched new highs in March supported by a weaker US Dollar, tariff fears, and ETF buying. The price per 10 grams of gold stood at a fresh all-time high of Rs 88,691, as of March 31, 2025, rallying by 4.6%.

Outlook: According to the World Gold Council (WGC), further weakening of the dollar is likely on waning US exceptionalism. Central banks have been strong contributors to gold’s performance over the past three years and show few signs of letting up, adding fundamental support to prices. Furthermore, US Gold ETF investors have not built up sizeable holdings in recent years, suggesting the capacity to keep adding.

WGC further added that by historical standards, the current rally isn’t particularly large or long. And comparing the current rally to the recent 2011 and 2020 peaks highlights that, relatively speaking, fundamentals look more solid.

But WGC also cautioned that there are risks for the gold price after a rally such as this in such a short space of time. Central banks could prudently slow their pace of buying given the price rally, as seen with some central banks last year. Additionally, any resolution regarding geopolitical and tariff front could bring the premium out.

One can consider tactically allocating around 10% to 15% of their investment portfolio to gold, ideally via Gold ETFs. However, if the exposure to gold has exceeded 10-15% of your portfolio amidst the rally it would be prudent to book some profit to bring back the portfolio to the desired allocation.

This article first appeared on PersonalFN here.

Disclaimer: The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.