The imposition of US tariffs and retaliatory tariffs by some trading partners, combined with a ninety-day pause of most “reciprocal” tariffs by US President Donald Trump, have led to extreme financial market volatility in recent days. While the equity market gyrations have occurred in relatively orderly market conditions so far, some recent developments have signaled that selling pressure may have spread to other markets—particularly US Treasury securities and short-term US dollar funding.

To understand the financial stability impacts of the current market turmoil, it is important to monitor the pressure on these markets, which are crucial for the smooth functioning of the global financial system. Left unaddressed, these strains could trigger a freezing up of financial markets, raising the risk of a serious financial crisis.

Safe haven asset status of US Treasuries in doubt

When financial markets come under stress, investors usually shift money into safe haven assets—which until now have been the US dollar and US Treasury securities. This time around, these markets have behaved differently from expectations. On April 2, when Trump announced higher than expected “reciprocal” tariffs, triggering sharp stock market selloffs, the ten-year US Treasury yield stood at 4.17 percent. Yields indeed fell (which means bond prices increased) in the next few days to reach 3.96 percent on April 4. But then yields rose in the following week to hit 4.34 percent (seventeen basis points higher than on April 2) at the end of April 9 when the stock market rallied after Trump announced the ninety-day reprieve. This is contrary to expectations. Usually, US Treasury yields decline during market turmoil as investors move to US Treasury securities as safe haven assets.

Similarly, the US dollar index (representing its value against the Group of Ten major trading partners) weakened from 104.2 on April 2 to 103.2 on April 9, instead of strengthening, as usually happens during market routs when international investors tend to flock to the US dollar for safety.

The lackluster performance of US Treasuries and the US dollar have raised questions about their status as safe haven assets. These questions are relevant in the context of the decline in the share of foreign holders of US Treasury securities—from more than 50 percent in 2008 to around 30 percent at present.

Strains in US dollar funding markets

In addition, the rise in US Treasury yields amid great volatility has caused hedge funds to unwind the basis trade. The basis trade consists of buying US Treasuries in the cash market while shorting US Treasury futures contracts, hoping to profit from the expected convergence of futures prices to cash Treasuries prices. Since the price differentials between the two instruments are quite small, hedge funds have to leverage their positions by fifty to one hundred times, usually borrowing money in the repo markets, to achieve decent returns. When the price of Treasuries fall amid great volatility, generating losses and margin calls by their brokers, hedge funds are forced to liquidate their positions to raise cash, reinforcing the downward price movements. While markets have been orderly despite these great price swings, the rush for cash has caused some strains in the US dollar funding markets. Take, for instance, the secured overnight financing rate (SOFR), a metric established in 2022 that reflects the cost of borrowing cash overnight, collateralized by Treasury securities. On April 8, the thirty-year SOFR swap spread fell to a record low of around -100 basis points.

Heightened volatility in the US Treasury market has spilled over to global bond markets, increasing volatility there as well. For example, yields on two-year German Bunds jumped by twenty basis points before subsiding. At one point in the past week, ten-year Japanese government bonds rose by thirteen basis points. These are unusually large rises for these government bond markets. The spikes in yields amid great volatility in both US and international bond markets, and the strengthening of major currencies such as the yen and euro so far this year, have generated losses in carry trades, where international investors borrow in low-interest-rate currencies like the yen or euro to invest in higher-yielding US Treasuries. These developments have led many investors to unwind their carry trades in search of cash, adding to selling pressure and strains in the cross-currency swap markets. For example, the three-month yen/dollar and euro/dollar cross-currency basis swap spreads have widened noticeably.

Focus on the Fed

The emerging strains in US dollar funding markets—both domestic and international—while not in crisis proportions, have started to focus market attention on the US Federal Reserve (the Fed). Global financial market participants have gotten used to the role of the Fed as the supplier of US dollar liquidity of last resort—adding ample liquidity to the financial system to stabilize severe financial crises. This time around, with a tariff war amid heightened geopolitical tensions, questions have been raised about whether such a Fed rescue can be taken for granted.

The high tariff rate in the United States—estimated to be around 24 percent, taking into account all the tariff actions in recent weeks—will likely have an impact on US price inflation, though the extent is still not fully clear. Fed officials have said that they would like to wait for more clarity on how tariffs will impact inflation and inflation expectations before easing. Having stressed that point, the Fed would likely be hesitant to move even though the latest consumer price index for March (which does not take into account last week’s tariff announcements) showed a larger than expected slowdown to 2.4 percent inflation on a year-over-year basis. The Fed will be especially reticent to act if such a move can be interpreted by investors as a preemptive easing to put a floor under the market turmoil.

Besides cutting key rates, the Fed has used other tools at its disposal, such as supplying financial markets with liquidity through purchases of Treasury securities or via the repo markets. The Fed has also made dollar liquidity available to international investors through currency liquidity swap arrangements with foreign central banks. Currently, the Fed has standing liquidity swap lines with the central banks of Great Britain, the eurozone, Japan, Canada, and Switzerland. These lines can be supplemented with temporary and limited swap agreements with a wider range of foreign central banks like in the case of the global financial crisis in 2008. These actions by the Fed have been criticized by some US lawmakers as “bailouts” to financial firms and speculators that create a moral hazard and weaken market discipline. Under present political circumstances, some doubt has arisen about the Fed’s willingness to use these tools—unless the market turmoil starts to seriously threaten global financial and economic stability. Furthermore, there has been speculation that the United States could leverage the Fed’s financial safety net for political purposes—by being more selective and requiring compensation. These emerging doubts about the reliability of the Fed’s financial safety net will likely heighten the uncertainty in global financial markets.

As the tariff war continues and equity markets fluctuate with each new announcement, the state of the US Treasuries and US dollar funding markets, as well as actions of the Federal Reserve, will help indicate whether market turmoil risks tipping into a financial crisis.

Hung Tran is a nonresident senior fellow at the Atlantic Council’s Geoeconomics Center, a senior fellow at the Policy Center for the New South, and a former senior official at the International Institute of Finance and International Monetary Fund.

Further reading

Thu, Apr 10, 2025

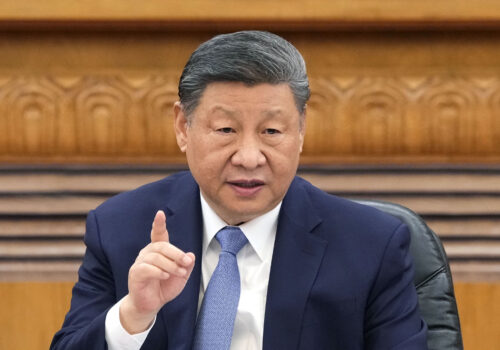

What to expect as Trump’s trade war zeroes in on China

Fast Thinking By

On April 9, US President Donald Trump announced that he would suspend many of his “liberation day” import tariffs—but he raised the tariff on China to 145 percent.

Thu, Apr 10, 2025

China is ready to ‘eat bitterness’ in the trade war. What about the US?

New Atlanticist By Dexter Tiff Roberts

As the US imposes a 145 percent tariff on Chinese imports, officials in Beijing are turning to a belief that Chinese people will endure hardships in service of a national goal.

Tue, Apr 8, 2025

No one is coming to save the global economy

New Atlanticist By Josh Lipsky

Neither the Group of Twenty nor the Federal Reserve should be expected to use their playbook from previous economic crises to respond to economic shocks caused by US tariffs.

Image: A man walks on Wall Street outside the New York Stock Exchange (NYSE) in New York City, U.S., April 7, 2025. REUTERS/Brendan McDermid