Risk assets surge as Trump cuts reciprocal tariffs to 10% for nations that asked for talks - Newsquawk Europe Market Open

- Trump lifted the tariff on China to 125% with immediate effect, announced a 90-day pause & cut reciprocals to 10% for nations that asked for talks.

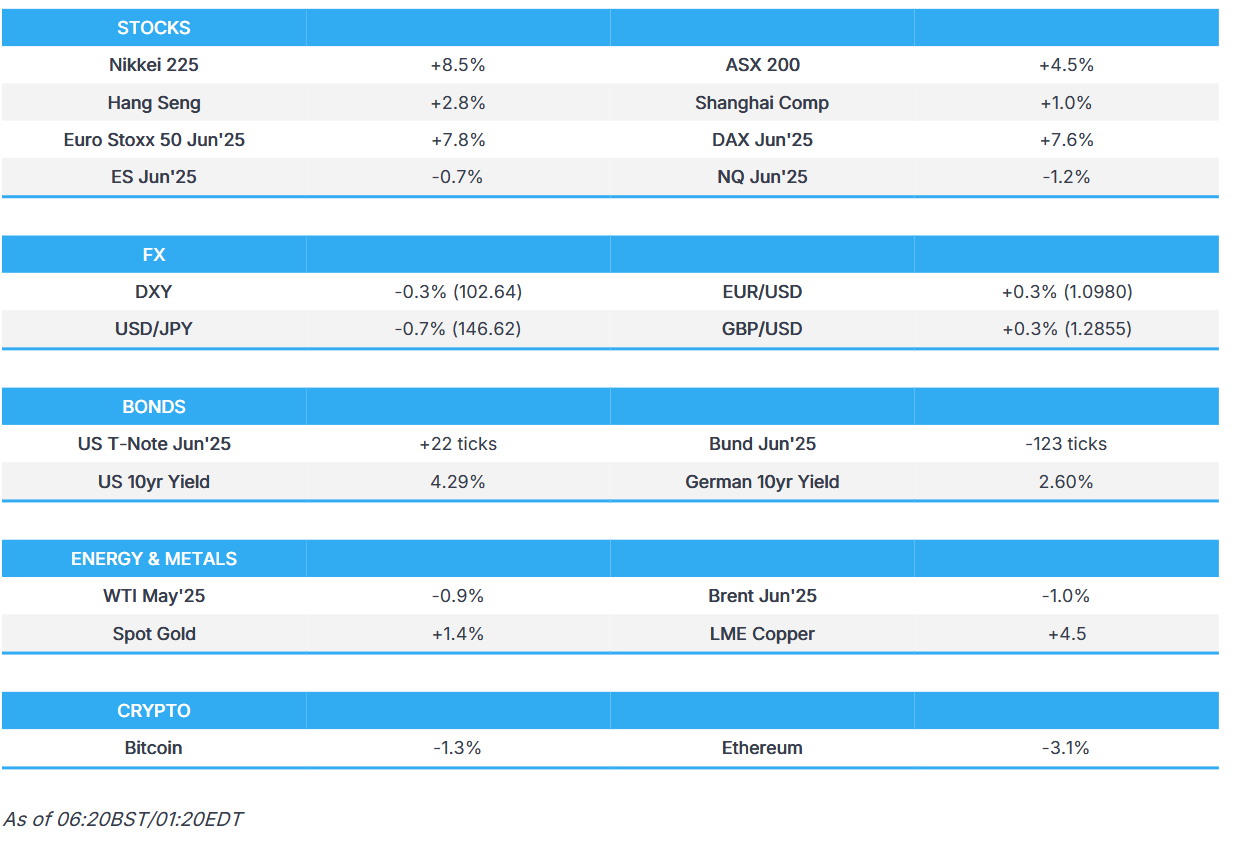

- Sparked significant risk on with US bourses closing higher by around 10%, APAC stocks surged & European futures are markedly higher.

- DXY gave back Wednesday's strength, FOMC Minutes a non-event; EUR higher but shy of 1.10, USD/JPY faded from highs above 148.00.

- USTs rebound from lows, aided by a strong 10yr tap. Bunds & JGBs hit on the 90-day pause.

- Crude followed the broader risk tone, metals surge.

- Looking ahead, highlights include Norwegian & US CPI, US Jobless Claims, Chinese M2 Money Supply, Speakers including RBA’s Bullock, BoE’s Breeden, Fed’s Logan, Bowman, Schmid, Goolsbee & Harker, SNB’s Tschudin & Moser, Supply from Spain & US.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were volatile but ultimately saw historic upside (SPX +9.5%, NDX +12.0%, RUT +8.7%, DJI +7.9%) as US President Trump implemented a 90-day pause on reciprocal tariffs to the 75 countries who approached the US for talks with their tariff rates dropping to the baseline 10% to allow time for negotiations. However, Trump also announced he will be increasing China tariffs even higher to 125% from 104% after China responded to the additional US tariffs, by implementing 84% tariffs, up from 34%. Bonds were incredibly choppy but settled well in the red with chunky selling pressure seen overnight, while the dollar rallied from its lows and money markets are fully pricing in three Fed rate cuts this year vs four priced on Tuesday.

- SPX +9.52% at 5,457, NDX +12.02% at 19,145, DJI +7.87% at 40,608, RUT +8.66% at 1,913.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump raised the tariff charged to China by the US to 125% from 104% effectively immediately, but authorised a 90-day pause and lowered reciprocal tariffs to 10% during this period on the 75 countries that asked for talks.

- US President Trump said he announced a tariff pause because people were getting afraid and jumping out of line. Trump also said that China wants to make a deal and doesn't know how to go about it, while he added nothing is over yet and a deal could be struck with China. Trump responded a deal could be made with everyone when asked about an EU deal, as well as noted it is working out maybe faster than he thought and said have to be flexible with tariffs. Furthermore, he said the bond market now is beautiful and they will take a look at exempting some US companies.

- US President Trump said he was thinking about pausing tariffs for the past few days and the decision to pause tariffs came together on Wednesday morning, while he added they don't want to hurt countries that don't need to be hurt and that sectoral tariffs are still coming. President Trump also said he thinks they will end up making a very good deal with China, as well as stated he is not concerned about escalation with China outside of the trade war and 'can't imagine' a further increase of tariffs on China.

- US Treasury Secretary Bessent said countries who did not retaliate will be rewarded and that China tariffs are being raised due to retaliation. Bessent said they will work on a solution with trading partners and the US is expecting countries to come with their best deal. Furthermore, he said the pause allows time to negotiate and it is not because of the market's reaction.

- White House said there is no 10% baseline tariff on Canada and an official confirmed there was no change to autos, steel and aluminium tariffs, as well as no change to Canada and Mexico tariffs. Furthermore, a White House official commented that the 90-day 'pause' on tariffs does not apply to tariffs on Canada and Mexico, with the 25% tariff on non-USMCA trade with Canada and Mexico to remain in effect, except for the 10% tariff on energy and potash.

- US Commerce Secretary Lutnick expects the EU will delay its planned tariff retaliation after Trump's announcement. It was separately reported that the EU weighs buying more US gas due to Trump tariff pressure, according to FT.

- White House trade advisor Navarro said every US trade deal is going to be tailor-made and this is unfolding exactly the way it should, while he added tariff talks are going to move "fast and beautifully".

- China's Commerce Minister said China is willing to resolve differences through consultation and negotiation, but reiterated if the US side is bent on having its own way, China will fight it to the end and noted the so-called ‘reciprocal tariffs’ of the United States are a serious infringement of the legitimate interests of all countries. China's Commerce Minister also held talks with EU trade chief Sefcovic and said that China is willing to deepen China-EU trade, investment and industrial cooperation, while he added the two sides will discuss trade transfer issues, and handle trade frictions properly.

- Shenzhen E-commerce Association representing over 3,000 Amazon (AMZN) sellers said tariffs make it very hard to survive in the US market and some sellers are still proceeding to ship goods to the US, while others are trying to find new markets. Furthermore, it stated that US tariffs are an unprecedented blow and will lead to the collapse of more small and medium-sized businesses and rapidly accelerate China’s unemployment rate.

- Canada's PM Carney said the pause on reciprocal tariffs announced by US President Trump is a welcome reprieve for the global economy, while he added that Trump's signal that the US will engage in bilateral negotiations, would likely result in a fundamental restructuring of the global trading system.

- UK and India have agreed 90% of their free trade agreement, according to sources cited by The Guardian..

FOMC MINUTES

- FOMC Minutes stated all participants viewed it appropriate to keep rates unchanged in light of the uncertainty around the economic outlook and participants remarked uncertainty about the net effect of government policies on the outlook was high, making it appropriate to take a cautious approach. Furthermore, some participants assessed the FOMC was well positioned to wait for more clarity on the outlook and some participants observed the FOMC may face difficult trade-offs if inflation proved more persistent while the outlook for growth and employment weakened.

NOTABLE HEADLINES

- Fed's Hammack (2026 voter) said their desk stands ready to engage in money markets if needed but have been seeing markets work themselves out, while she added that markets are strained but functioning.

- Fed's Kashkari (2026 voter) said things have changed dramatically this afternoon and there'll be a little less of an impact on inflation if the tariff pause endures, but added uncertainty could still cause an economic downturn. Furthermore, he said tariffs can cause inflation and that the bar for cutting rates is still high.

- Fed's Barkin (2027 voter) said the trade war is likely to cause fewer jobs and higher prices, but price hikes may not show up until the summer, as companies work through pre-tariff inventories, according to Axios. Barkin also said he is watching consumers closely and it is the biggest part of the economy, while he worries if they are close to a moment where consumers decide to pull back but noted this has not happened so far.

- US President Trump signed an executive order requiring the automatic rescission of outdated regulations to unleash American innovation and energy production. Trump also signed orders on restoring maritime dominance and modernising defence acquisitions which will scrutinise programs 15% over costs or 15% behind schedule and directs DHS to enforce collection of harbour maintenance fee and other charges on foreign cargo. Furthermore, the maritime order establishes a maritime security trust fund and shipbuilding financial incentives program, as well as directs an increase in the fleet of US-flagged commercial vessels.

- US President Trump’s administration reportedly threatens to scrap consultancy contracts after "insulting" proposals, according to FT. It was separately reported that the Trump administration backed off Nvidia's (NVDA) H20 chip crackdown after the CEO's Mar-A-Lago dinner, according to a report cited by CNBC.

- US Senate confirmed Paul Atkins for the Securities and Exchange Commission chair role.

- US House Speaker Johnson scrapped the vote on the Trump budget blueprint amid conservative opposition.

- Goldman Sachs rescinds recession call after Trump tariff pause.

APAC TRADE

EQUITIES

- APAC stocks surged following the historic rally on Wall St where the S&P 500 posted its biggest gain since 2008 after US President Trump announced a 90-day pause on reciprocal tariffs to countries aside from China.

- ASX 200 rallied with the broad-based gains led by outperformance in the tech and energy sectors, while National Australia Bank revised its RBA forecast in which it now sees an oversized 50bps cut in May and the OCR to decline to 2.6% by February next year.

- Nikkei 225 rocketed to back above the 34,000 level as Japanese exporters cheered the tariff-related relief.

- Hang Seng and Shanghai Comp joined in on the global rally but with the advances somewhat moderated in the mainland after US President Trump upped the total tariffs on China to 125% from 104% due to China's recent retaliation, while reports also reported that Chinese leaders are to meet on stimulus following the tariff shock.

- US equity futures took a breather and pared some of the prior day's significant gains after Trump dialled back on tariffs.

- European equity futures indicate a considerably higher cash market open with Euro Stoxx 50 futures up 8.4% after the cash market finished with losses of 3.2% on Wednesday.

FX

- DXY gave back the prior day's gains after strengthening on President Trump's announcement of a 90-day pause on the higher reciprocal tariffs for countries which will revert to the baseline 10% level immediately but announced to increase tariffs on China to a total 125% from 104% after China's recent retaliation. The release of the latest FOMC Minutes was a non-event as tariff headlines remained centre stage and with remarks from Fed speakers seen as outdated given the tariff policy changes, while participants now look ahead to US CPI data and a series of Fed speakers scheduled later today.

- EUR/USD mildly edged higher but with gains capped after pulling back from resistance just shy of the 1.1100 level to ultimately return to flat territory yesterday, while the EU previously announced it would impose countermeasures against the US although Commerce Secretary Lutnick now expects the EU will delay its planned tariff retaliation after Trump's 90-day pause announcement.

- GBP/USD eked marginal gains but with upside capped after this week's choppy price action through the 1.2800 level.

- USD/JPY faded some of the prior day's gains after surging to briefly above the 148.00 level owing to President Trump's 90-day reciprocal tariff pause, while the latest Japanese PPI data also printed firmer than expected.

- Antipodeans extended on recent gains after benefitting from the broad risk-on mood which helped participants shrug off the softer-than-expected Chinese inflation data and the continued weakening of the CNY reference rate.

- PBoC set USD/CNY mid-point at 7.2092 vs exp. 7.3484 (Prev. 7.2066).

FIXED INCOME

- 10yr UST futures gradually rebounded from yesterday's lows as President Trump's 90-day pause announcement provided much-needed relief from tariff-related turmoil, while there was also a very strong 10yr auction stateside.

- Bund futures slumped as risk assets surged after US President Trump paused reciprocal tariffs for countries aside from China.

- 10yr JGB futures nosedived on the positive tariff developments and amid outperformance in Japanese stocks, although some support was seen after a strong 5yr auction.

COMMODITIES

- Crude futures mildly pulled back after surging around 5% yesterday in the aftermath of Trump's 90-day reciprocal tariff pause.

- Spot gold remained underpinned and reclaimed the USD 3,100/oz level after steadily climbing through the prior day,

- Copper futures surged as risk appetite was reignited as Trump essentially backed down in the global trade war.

- Chile's Mining Minister said copper demand could slow in the short term due to uncertainty over US tariffs and said copper producers in Chile could redirect global supply routes if faced with an unfavourable trade situation.

- Peru Mining Chamber said Peru's 2025 copper production is expected to increase by 2-4%.

CRYPTO

- Bitcoin partially reversed the prior day's gains after rallying on the tariff pause announcement.

NOTABLE ASIA-PAC HEADLINES

- Chinese leaders are to meet on stimulus following President Trump's tariff shock, according to Bloomberg.

- China Commerce Ministry said any TikTok US business arrangement must comply with Chinese laws. It was separately reported that White House officials are said to be conceding that the potential TikTok US deal is off the table for the foreseeable future, and maybe forever, as the trade war focuses solely on China, according to Fox's Gasparino. However, President Trump commented have to wait and see what happens with China on the TikTok deal and that it is still on the table.

- Japan nominated former Mitsubishi Corp. executive Kazuyuki Masu as the new BoJ board member.

- Taiwan's central bank said it will continue to hold US treasuries and sees it as ideal to have US treasuries as more than 80% of its forex reserves, while it will assess whether or not to increase this.

DATA RECAP

- Chinese CPI YY (Mar) -0.1% vs. Exp. 0.0% (Prev. -0.7%)

- Chinese PPI YY (Mar) -2.5% vs. Exp. -2.3% (Prev. -2.2%)

- Japanese Corp Goods Price MM (Mar) 0.4% vs. Exp. 0.2% (Rev. 0.2%)

- Japanese Corp Goods Price YY (Mar) 4.2% vs. Exp. 3.9% (Prev. 4.0%, Rev. 4.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli official confirmed that Turkish and Israeli officers are discussing the establishment of a deconfliction mechanism between the two militaries in Syria.

- US President Trump reiterated Iran cannot have a nuclear weapon and said that if it requires military, "we're going to have military" with Israel to be involved with that.

RUSSIA-UKRAINE

- More than 150 Chinese citizens have reportedly joined the Russian military to fight against Ukraine, according to Ukrainian intelligence reports viewed by WSJ.

EU/UK

NOTABLE HEADLINES

- ECB's Villeroy said US politics is marked by huge unpredictability.

DATA RECAP

- UK RICS Housing Survey (Mar) 2.0 vs. Exp. 8.0 (Prev. 11.0)

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.