Zinger Key Points

- President Trump just announced a 90-day tariff pause for some countries, igniting a rally in Citigroup.

- Because the fundamentals may not have materially changed, C stock put spreads could still be tempting.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

President Donald Trump ignited a market rally Wednesday afternoon, announcing a 90-day pause on tariffs on some countries while simultaneously raising levies against Chinese goods to 125%. Trump appeared to telegraph the announcement earlier today on Truth Social, writing, "BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!"

Naturally, the about-face represents positive tidings for banking giant Citigroup Inc C, which saw its market value pop about 6% within the first half-hour of the breaking news. Just before the temporary tariff reprieve, C stock was down approximately 3% from Tuesday's close. Now, the risk-reward pendulum has swung the other way, with bulls cheering the encouraging development.

Nevertheless, contrarian investors may question the viability of the Trump administration's policy directive. For one thing, the constant tariff threats and walk-backs represent nightmares for inspiring trust and cooperation among key economic partners. More importantly, today's breaking news does little to solve simmering tensions between the U.S. and China.

Trump's tariff-induced sell-off has already wiped out $9 trillion in equity capital over the last six weeks, rivaling the $9 trillion lost during the COVID crash in 2020, which occurred over a one-month period. Until this giant pink elephant in the room is addressed, critically thinking traders may still look to bet against C stock.

How to Play the Whipsaw Effect in C Stock

With the market in a euphoric state following the tariff pause, it's not a great idea to stand in front of the freight train. That said, when the jubilation finally does fade, the correction could be quite severe. Those who want to anticipate this ebb and flow may consider a strategy called the bear put spread.

A multi-leg options strategy, the bear put spread features two transactions: a trader buys a put option and simultaneously sells a put (for the same expiration date) at a lower strike price. The proceeds from the short put partially offsets the debit paid for the long put, effectively resulting in a discounted net bearish position.

To be sure, this discount comes at the potential cost of an opportunity. Should the target security fall materially below the short strike price, the speculator is not rewarded for this extra performance as the short put would then be assigned (that is, the other side of the transaction will exercise the option).

Still, for the discount and the short time frame involved, many traders readily accept this tradeoff.

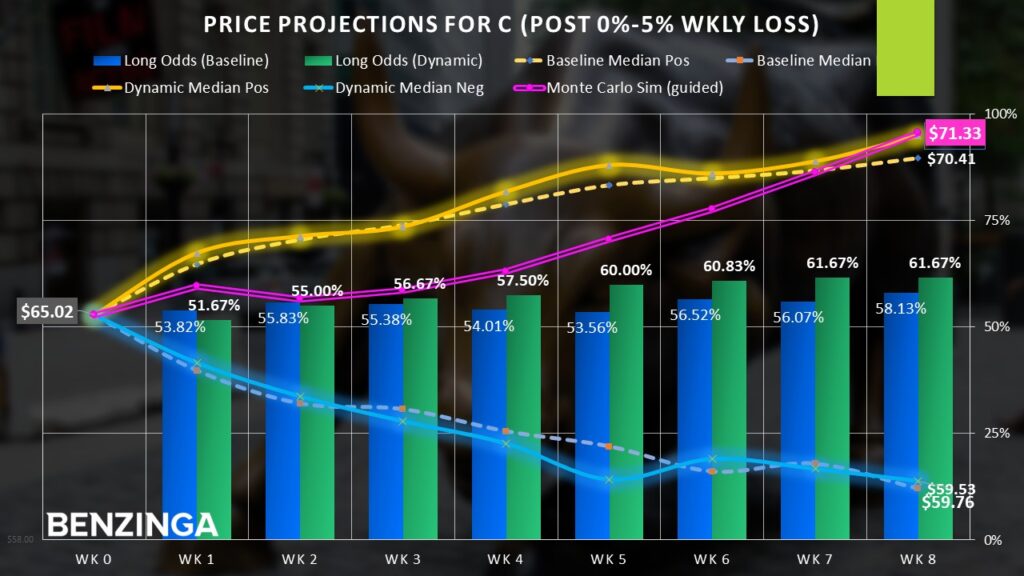

As for C stock, it's important to remember that the security was already titled downward before today's reprieve. Between December of last year and March of this year, the equity appeared to print a pattern reminiscent of a bearish head and shoulders. If the implication of this pattern holds true, it may be difficult for the stock to break above the $65 neckline.

Statistically, it should be noted that C stock enjoys an upward bias, which isn't all that surprising given that it's one of the big banks. However, the unusual threat posed by the current volatile trade war suggests there could be greater downside risk than one might anticipate based on historical norms.

Looking at the Bigger Picture

With C stock on pace to gain double-digit-percentage points for Wednesday, it's tempting to ride the wave higher. However, the fundamentals may not justify this. In the bigger picture, the Trump administration has major issues to resolve. Hesitating on an ill-advised policy doesn't necessarily make it a good policy.

With that said, traders who want to bet aggressively against the sudden shift in prevailing sentiment may consider the 65/62 bear put spread for the options chain expiring on April 25. This trade assumes that the bulls will attempt to push momentum higher, but the broader fundamentals will eventually catch up to the fervor.

When the morning-after effect takes over, C stock could eventually correct.

Those who want to participate in the above trade will buy the $65 put and simultaneously sell the $62 put. At time of writing, the net debit required to enter this trade is $159, with speculators looking to ultimately collect $141 should C stock fall to $62 or below at the April 25 expiration date.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.