Private equity market bullish on resurgence in deals

Private equity chiefs have become bullish for a surge in deals this year, in a rare piece of good news for the London Stock Exchange.

When polled, 79 per cent of private equity general partners said they were expecting returns to rise this year, compared to just 24 per cent in 2024, data from Investec revealed.

Expectations for fundraising have also surged, with 38 per cent anticipating that their next fund will be a blockbuster increase of 25 per cent or more.

Only three per cent of private equity partners are expecting a down raise for their next fund, compared to 21 per cent last year.

“Our research indicates that positive sentiment is significantly up across the industry, with expectations of higher returns and larger fund sizes,” said Jonathan Harvey, fund solutions at Investec.

“This suggests that the dry powder accumulated over the last few years may be deployed into the market this year.”

Over half of the private equity partners said they were considering at least two of their portfolio companies for a float over the next two years.

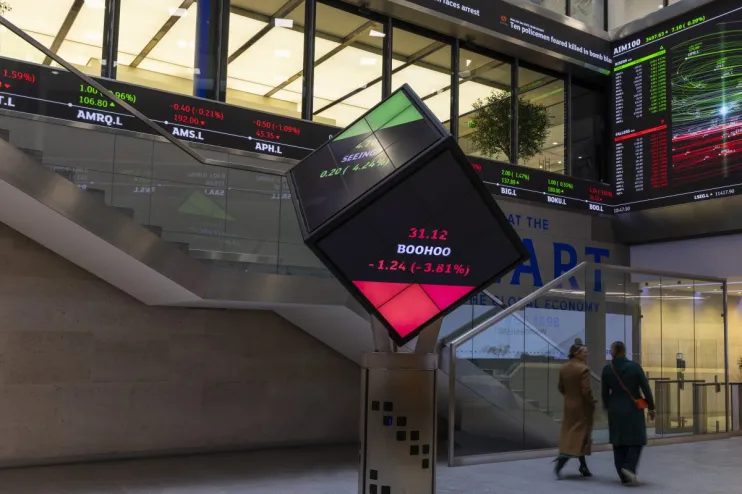

Things are also looking up for the London Stock Exchange, with 65 per cent of general partners who were considering an IPO as an exit looking to the UK market.

Last year, London’s share of global IPOs plunged, with the UK falling to 35th among all stock exchanges after raising only $576.7m (£459m), just 0.53 per cent of the global market.

Meanwhile, 54 per cent of private equity partners told Investec they will have new lenders to work with this year, marking a dramatic shift from last year’s findings, where 56 per cent of respondents expected a contraction in new lender activity.

“While sentiment is clearly up and expectations for a positive deal environment are high, it is evident that headwinds remain,” added Harvey.

“We are likely to see a pickier market as deals come under increased scrutiny, with dealmakers needing to navigate heightened levels of both geopolitical and macroeconomic challenges throughout the year.”