PHOTO

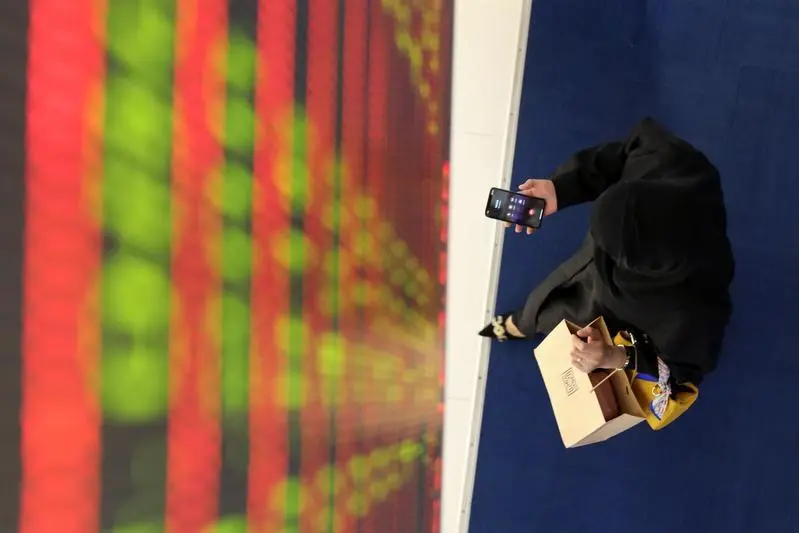

Bundle of Arab Money. Getty Images/Gulf Images RF

New Development Bank, formerly known as the BRICS Development Bank, sold a US$1.25bn 4.375% three-year bond at SOFR plus 65bp, 10bp inside initial guidance.

The bonds were printed at 99.876 to yield 4.42%.

The final book reached US$1.9bn from 35 accounts, including US$1bn from the leads. Asian investors were allocated 82%, EMEA 16% and the US 2%. Banks took 67%, central banks, official institutions and sovereign wealth funds 23%, and asset managers, fund managers and others 10%.

Bank of China, Emirates NBD Capital, DBS Bank, ICBC, Natixis, Standard Bank, Standard Chartered and State Bank of India were joint lead managers on the Reg S transaction.

The issuer, a multilateral development institution established by the BRICS countries to mobilise capital for infrastructure and sustainable development projects, is rated AA+/AA (S&P/Fitch).

Proceeds will be used for general corporate resources, including to finance or refinance disbursements of loans directed to projects in Brazil, India, China, South Africa, Egypt, and Bangladesh.

Source: IFR