Highlights

- February saw significant volatility, with the CCi30 index dropping 27% and Bitcoin down 18%.

- Portal Asset Management focuses on risk management with its two key funds: the Portal Digital Fund and the Radiance Multi-Strategy Fund.

- The Portal Digital Fund, an actively managed Global Fund of Hedge Funds, ended February down 10.7%.

- The Radiance Multi-Strategy Fund showed resilience by extracting over 3.7% in BTC, yielding 10.2% year-to-date.

Portal Asset Management, a company specialising in listed cryptocurrencies and other crypto assets, has maintained a thoughtful and adaptive approach within the dynamic digital asset market. By emphasising risk management, diversification, and long-term growth, the firm focuses on addressing the complexities of market fluctuations. Portal provides investors with structured opportunities through its two main offerings: the Portal Digital Fund and the Radiance Multi-Strategy Fund, aiming to balance innovation with stability in the evolving digital currency sector.

Market Turmoil: Digital Assets Struggle Amid Geopolitical Tensions

The digital asset market faced significant challenges in February, influenced by geopolitical tensions and macroeconomic shifts. The CCi30 index dropped by approximately 27%, with Bitcoin (BTC) declining by 18%. Uncertainties surrounding US trade tariffs and the potential withdrawal of US support for NATO in the Ukrainian-Russian conflict heightened market volatility. Additionally, the breakdown of the BTC Carry Trade, with futures trading below spot prices, caused rapid unwinding of positions and further amplified the market's instability.

Radiance Fund Achieves Over 3% BTC Growth Amid Market Volatility

Launched in July 2022, the Radiance Multi-Strategy Fund offers investors a curated diversification approach across top-tier tokens from key blockchain sectors, including Layer 1, Layer 2, Interoperability, NFTs, DeFi, Play2Earn, and Gaming.

The Radiance fund finished February down 28.1% in mark-to-market value. However, the fund achieved a positive outcome by extracting an additional 3.7% in BTC, bringing its year-to-date yield to +10.2%, with an average return of 5.1% per month, as per the company.

Additionally, on 01 January, the Radiance Multi-Strategy Fund transitioned to its Bitcoin Extraction Strategy (BESt). The company highlights that this derivatives premium strategy is designed to generate income in Bitcoin from BTC price fluctuations. This approach leverages Bitcoin’s volatility to create potential income streams while maximising exposure to the cryptocurrency’s growth.

Portal Digital Fund: Focused on Long-Term Growth

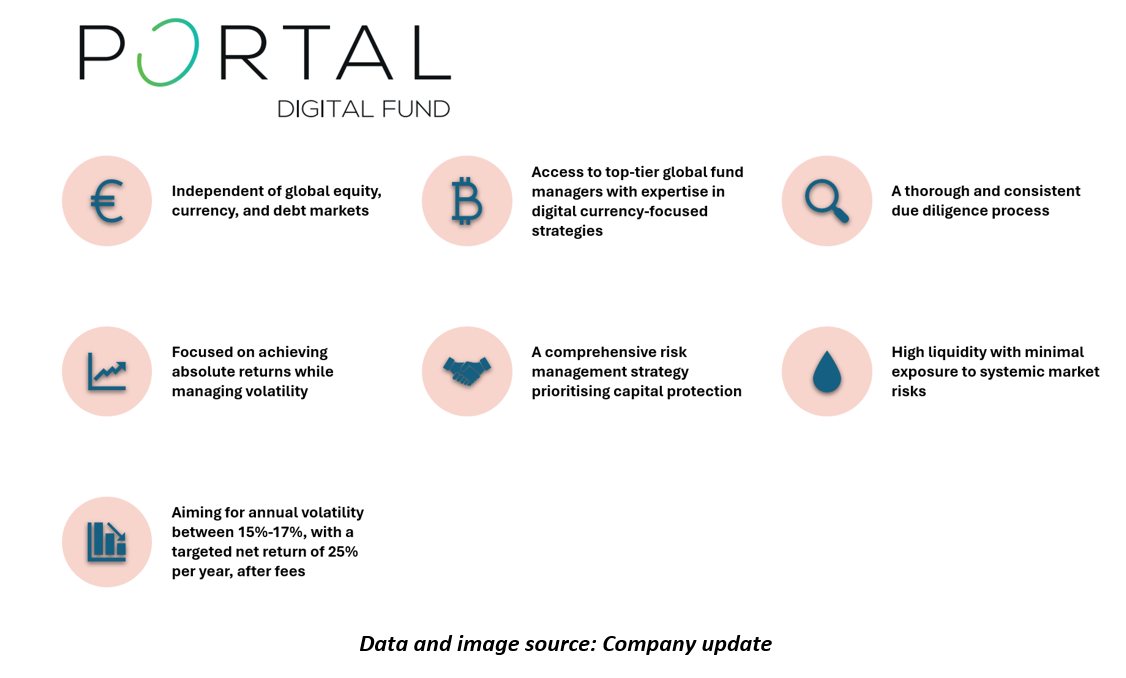

The Portal Digital Fund is an actively managed Global Fund of Hedge Funds targeting the cryptocurrency and digital asset investment space. The fund’s strategy involves investing in a diversified portfolio of 8-10 specialist fund managers employing uncorrelated investment and trading strategies.

However, amid the market turmoil, Portal Digital Fund ended February down 10.7%.

During uncertain times, investors seek firms with strategic approaches for asset protection and growth. Portal Asset Management’s focus on risk management through diversification and long-term value has been key to navigating challenging periods. However, one should carefully evaluate the risks involved before making any investment decisions.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.