Treasury bill rates climb

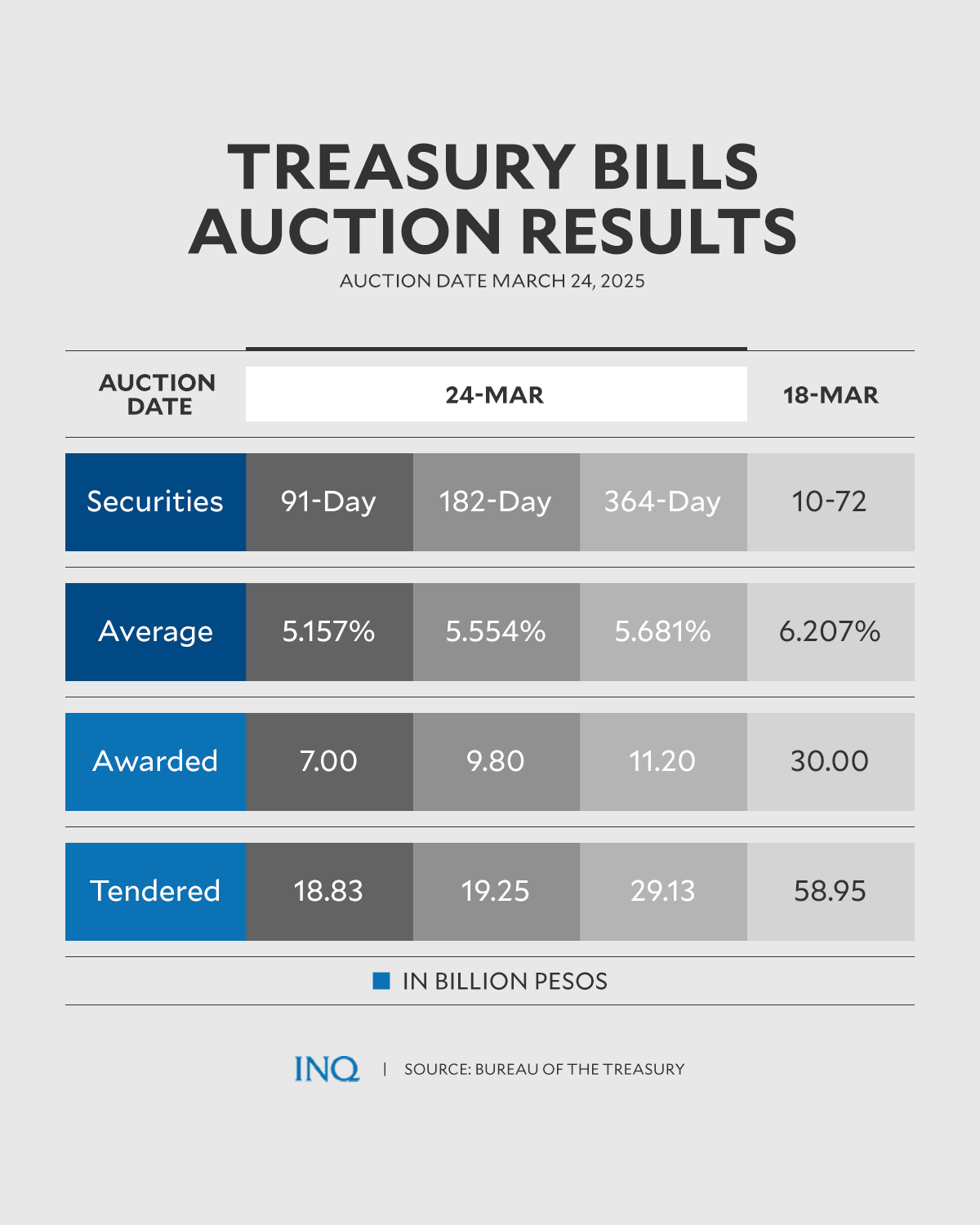

Results of the Treasury Bills auction on Monday, March 24, 2025.

Yields on short-dated local debts of the government snapped three straight weeks of decline during Monday’s sale of Treasury bills (T-bills) as markets awaited for clarity on the upcoming tariff actions of US President Donald Trump.

But auction results showed the Bureau of the Treasury (BTr) was still able to upsize its T-bills offering despite the higher rates, raising a total of P28 billion against the initial plan of P22 billion.

As it is, there was robust demand for the offering after attracting P67.2 billion in total bids, exceeding the original size of the issuance by 3.1 times.

READ: ‘Dovish’ BSP signals drag down T-bill rates

But Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said rates still went up ahead of the April 2 announcement of the White House on reciprocal tariffs on many countries.

“The latest Treasury bill average auction yields mostly corrected slightly higher after slightly declining for three straight weeks amid some market concerns over Trump’s reciprocal tariffs, which could lead to slower US economic growth and higher US inflation, and potentially lead to fewer Fed rate cuts,” Ricafort said.

The BTr said the 91-day T-bill fetched an average rate of 5.157 percent, more expensive than the 5.118 percent in the previous auction.

The average yield for the 182-day debt paper, meanwhile, rose to 5.554 percent from 5.496 percent before.

Lastly, local creditors asked for an average yield of 5.681 percent for the 364-day T-bill, cheaper than the 5.697 percent in the last offering.

For this year, the Marcos administration is targeting to borrow P2.55 trillion from creditors at home and abroad to plug a projected budget hole amounting to P1.54 trillion, or equivalent to 5.3 percent of the country’s gross domestic product.

By sources of financing, the government will borrow P507.41 billion from foreign investors in 2025. The remaining P2.04 trillion is targeted to be raised domestically, of which P60 billion will be via T-bills and P1.98 trillion via long-dated Treasury bonds.