Thursday Mar 27, 2025

Thursday Mar 27, 2025

Monday, 24 March 2025 02:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

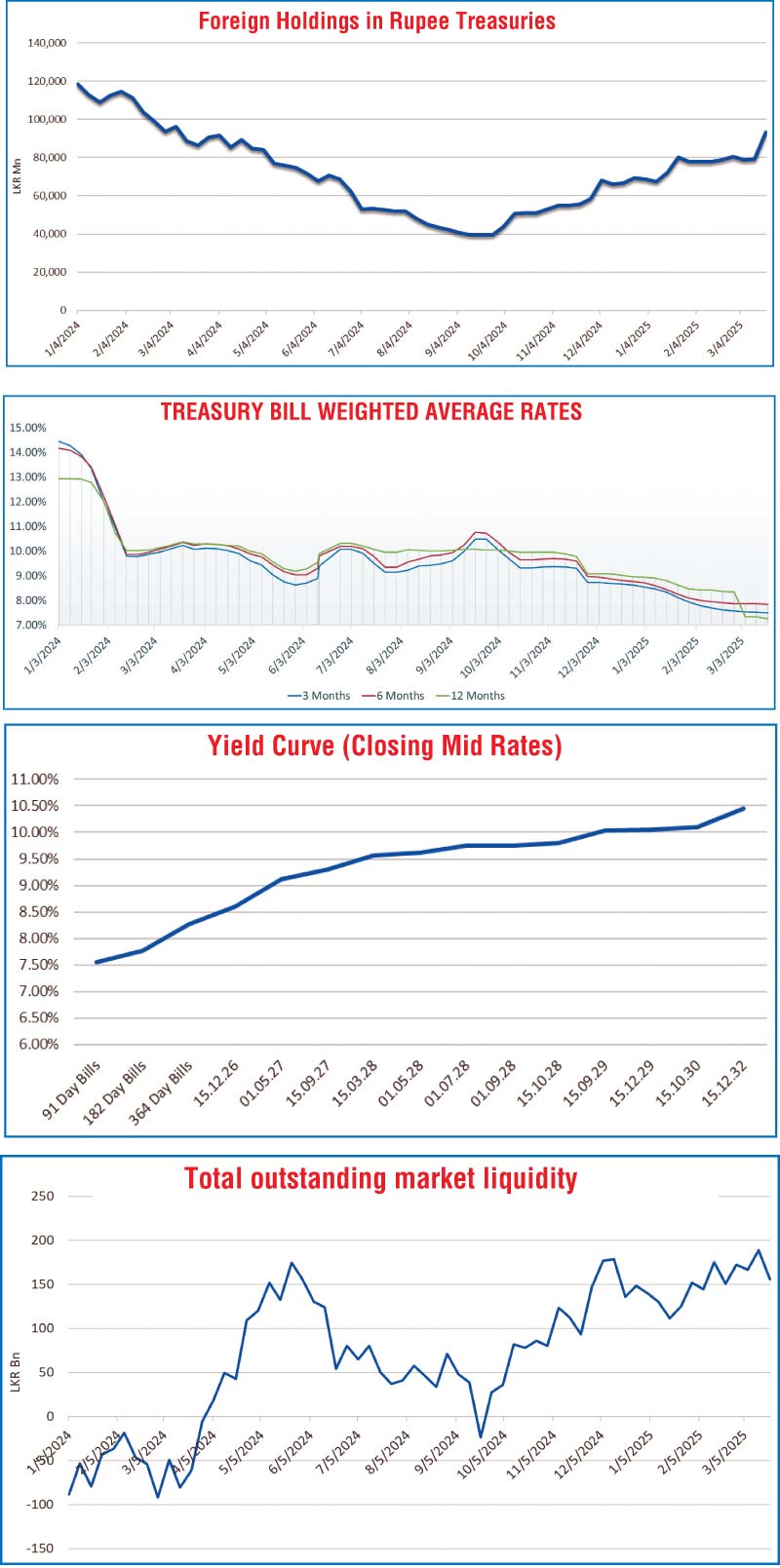

The Secondary Bond market last week rallied with aggressive buying interest pushing yields down drastically. Market activity and transaction volumes were seen at elevated levels, as strong demand was observed particularly on tenors from 2028 onwards. This was supported by relatively high overnight market liquidity at the start of the week, as well as a reduction in call money rates and repo rates. In addition, it was reported that Sri Lanka’s GDP grew by 5.00% during the year 2024 amidst a low inflation environment as annual average CCPI inflation was recorded at 1.20% for the period. In conclusion, two-way quotes were seen closing significantly lower on a week-on-week basis, particularly on mid-2028 tenors and beyond. This resulted in further bunching up and flattening of the yield curve.

The Secondary Bond market last week rallied with aggressive buying interest pushing yields down drastically. Market activity and transaction volumes were seen at elevated levels, as strong demand was observed particularly on tenors from 2028 onwards. This was supported by relatively high overnight market liquidity at the start of the week, as well as a reduction in call money rates and repo rates. In addition, it was reported that Sri Lanka’s GDP grew by 5.00% during the year 2024 amidst a low inflation environment as annual average CCPI inflation was recorded at 1.20% for the period. In conclusion, two-way quotes were seen closing significantly lower on a week-on-week basis, particularly on mid-2028 tenors and beyond. This resulted in further bunching up and flattening of the yield curve.

Accordingly, the yield on the 01.07.28 and 01.09.28 maturities declined from intraweek highs to lows of 10.10%-9.75% and 10.08%-9.75% respectively. The 15.10.28 and 15.12.28 maturities were seen trading down the ranges of 10.10-9.83% and 10.25%-9.85% respectively. The 15.09.29 maturity was seen trading down the range of 10.48%-10.03%, while the yield on the 15.12.29 maturity was seen declining down the range of 10.55%-10.05%. For reference, the 15.12.29 maturity was issued at auction just the week prior (on 12 March 2025) at the weighted average rate of 10.72%, reflecting a 67-basis point drop in yield. The rate on the 15.10.30 maturity was seen trading down from an intraweek high to a low 10.70%-10.15%. Similarly, the 15.12.32 maturity traded down the range of 11.35%-10.50%.

At the weekly Treasury Bill auction held last Wednesday (19/03/2025): weighted average yield rates declined across three offered maturities. This marked a continued downward trend, with yields on at least one tenor decreasing over the past 19 weeks consecutively. Accordingly, the weighted average rates on the 91-day tenor dropped by 2 basis points to 7.50%, the 182-day tenor by 02 basis points to 7.84% and the 364-day tenor by 9 basis point to 8.25%. Total bids received exceeded the offered amount by 2.12 times, and the entire Rs. 143.00 billion on offer was successfully raised in the first phase in competitive bidding. Maturity-wise: the 91- and 182-day tenors raised less than their respective offered amounts, with the shortfall being covered by raising more on the 364-day tenor.

The foreign holding in Rupee Treasuries recorded an impressive net inflow – the largest since June 2023 - for the week ending 21st March 2025 amounting to Rs 14.09 billion, and as a result the total holding rose to Rs. 93.36 billion. This marks the highest level that the holding has recorded since early March 2024.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at

Rs. 34.91 billion.

In money markets, the total outstanding liquidity surplus decreased to Rs. 155.98 billion as at the week ending 21 March, 2025, from Rs. 188.61 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the rates of 7.95%-7.96% and 7.97%-7.99% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,511.92 billion as at 21 March, 2025, unchanged from the previous week’s closing level.

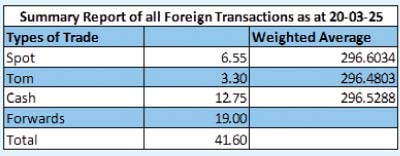

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating marginally, to close the week at Rs. 296.60/296.80 as against its previous week’s closing level of Rs. 295.50/295.60 and subsequent to trading at a high of Rs. 295.90 and a low of

Rs. 297.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 70.43 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.