Gold reigns supreme at 3,000

Gold has smashed through $3,000 per ounce, peaking at $3,057 on Thursday before closing at $3,022 last Friday – a new all-time high. A year ago, we flagged its quiet ascent amid the AI and crypto craze, when it hit $2,195 (see Gold’s Stealthy Ascent to Record Highs, March 18, 2024).

Now, with the US markets tumbling, trade wars simmering, sticky inflation, looming recession and possible stagflation, gold is not just back – it is reigning supreme.

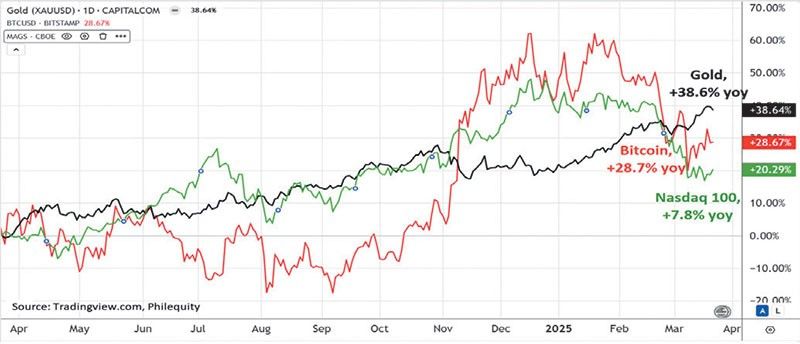

Over the past year, gold has surged by 38.6 percent, outpacing Bitcoin’s 28.7 percent climb and leaving the Magnificent Seven - which led last year’s AI boom - trailing at a mere 7.8 percent gain. That 7.4 percent weekly jump in gold which we noted in our March 2024 article was a hint, a quiet roar drowned out by crypto and tech noise. The gold rush today is fueled by a faltering US economy, China’s AI-driven resurgence and a world filled with uncertainty caused by Trump’s unpredictable and arbitrary behavior.

Gold shines as safe-haven

While Trump’s erratic and baffling policies sent the dollar and markets into a tailspin, gold is shining as the ultimate safe-haven. The DXY has slid by six percent from its 2025 peak, Bitcoin crashed by 20 percent and the Magnificent Seven has plummeted by 23 percent from their highs- all hammered by Trump’s escalating tariff threats. Some 52 percent of global fund managers surveyed by Bank of America said that they view gold as “the best hedge against a full-blown trade war.”

Geopolitics and central banks pile in

Last year, we flagged escalating geopolitical tensions – US-China friction, Middle East wars, Ukraine’s fallout and the South China Sea dispute as drivers behind gold’s breakout. The freezing of Russia’s $300 billion assets in 2022 lit the fuse, spurring countries like China and Saudi Arabia to stockpile gold against economic retaliation.

China’s gold rush fuels the fire

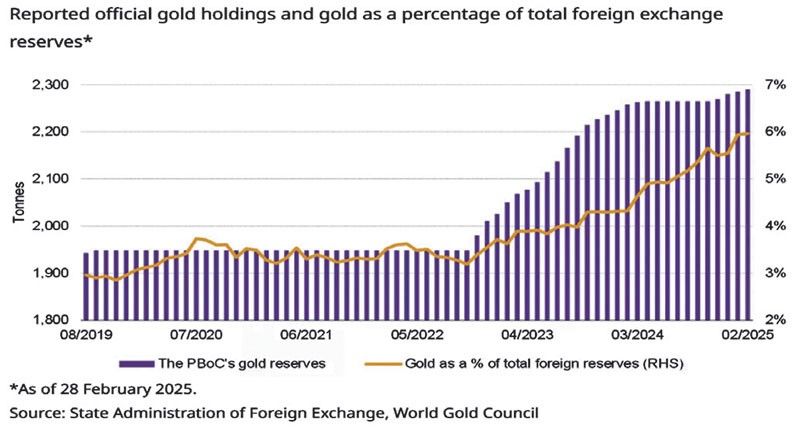

In recent months, China is piling into gold which is turbocharging its rally. China paused its gold-buying spree for six months (May to October 2024) but resumed buying in November. According to the World Gold Council, China’s gold holdings reached a record high of 2,290 tons in February 2025 – accounting for 5.9 percent of its total foreign exchange reserves. It is dwarfed by both US and Germany, where gold represents approximately 70 percent of their respective forex reserves.

Meanwhile, Chinese investors are all-in with Chinese gold ETFs adding a record $1.9 billion in February alone, lifting holdings by 21 tons to an all-time high of 131 tons. Trump’s trade war may be sparking this haven flows with coins, bars and jewelry flying off shelves as China’s real-estate market continues to face a slump.

Gold rules in a volatile world

From a quiet initial 7.4 percent nudge to a towering 38.6 percent year-on-year surge, gold’s reign at $3,022 is no fluke. Trump’s trade war threats and policy flip-flops have turned markets upside down, but the rush toward gold – especially by Chinese investors seeking shelter from both economic uncertainty and real estate weakness – shows that investors are betting big on the metal. With geopolitics simmering and countries buying gold instead of US financial instruments to hedge against confiscation risks – prompted by the freezing of Russian assets – gold is not just a haven. It may be the steadiest bet in a shaky, volatile world.

Philequity Management is the fund manager of the leading mutual funds in the Philippines. Visit www.philequity.net to learn more about Philequity’s managed funds or to view previous articles. For inquiries or to send feedback, please call (02) 8250-8700 or email ask@++philequity.net.

- Latest

- Trending