Following are seller, buyer, property description and price of property. Note: Price is an estimate based on revenue stamps that are bought from the county.

HENRY COUNTY WARRANTY DEEDS

Foreclosure Management Services LLC, to Williams, Tony, 824 Franklin St., Kewanee; $53,000.

Geneseo Prairie Development Inc., to Burke, Brian J. and Danielle N., Lot 29 of Prairie View subdivision, a subdivision located in a part of the southwest quarter of Sect. 15, Township 17 N, Range 3E of the 4th Principal Meridian; $45,000.

Diaz, Manuel and Patricia, to Herrera, Margarito and Gadalupe A., 606 E. 2nd St., Kewanee; $50,000.

CYV Kewanee AL Re LLC, to CTR Partnerships LP, 860 Sunset Drive, Kewanee; $608,500.

Murray, Richard T., to Goben, Frank, 1405 W. Prospect St., Kewanee; $142,000.

Schmidt, Douglas and Maggie, and Schmidt, Shane, to Turner, Margaret, 5145 S.W. 1st Ave., Galva; $70,000.

Calmer, Irle Aliza C., to Calmer, Marion K., farm ground, Alpha; $903,500.

Noe, Casey and Julie K., to Lentz, Braelyn Kay, and Brower, Kody Lane, 410 W. 1st St., Geneseo; $189,000.

Hannam, Trey J. and Megan, and Duncan, Paula M., to Sturtewagen, Kate M., 501 S. Depot St., Annawan; $190,000.

Kelly, John C. and Sherry L., to Krans, Karla J., 100 N. Center Ave., Galva; $40,000.

Nanninga, Larry E. Jr., to Loibl, Christian C., 1117 Western Ave., Kewanee; $57,500.

Crane, Robert C. and Karen S., to Frick, Tyler J., 469 Oakwood Circle, Coal Valley; $220,000.

ROCK ISLAND COUNTY WARRANTY DEEDS

Balvanz, Colton S. and Tiffany E., Altoona, Iowa, to Whitmore, Jerry L. and Theresa L., Rock Island; 2916 21st Ave., Rock Island; $187,000.

Midwest HomeBuyers, Eldridge, to Gutierrez, Oscar, East Moline; 1821 27th Ave., East Moline; $67,320.

Cornerstone Development Corp., Davenport, to Fawks, Benjamin J., Rock Island; 2108 3rd Ave., Rock Island, coffee shop; $170,000.

Sales, Paul, Eldridge, to Rursch, Stephanie, Milan; 503 29th Ave. W., Milan; $104,500.

Stickler, John Jr., Port Byron, to Griffin, Brady A., East Moline; 4110 6th Ave., East Moline; $139,900.

Hoepfner, Katherine, East Moline, to Simmon, Taylor, East Moline; 103 29th Ave., East Moline; $105,000.

Lafferty, Debra, Aledo, to Romeo, Joseph M., Rock Island; 3020 42nd St., Rock Island; $105,000.

Gonzalez, Manuel G., Silvis, to ROI Capital, Dahinda, Illinois; 143 8th St., Silvis; $82,500.

Park, Craig and Bobbie, Moline, to Nolen, Dalton K., Moline; 3824 15th St., Moline; $170,000.

Porter Development Group, Bettendorf, to Silverthorne Development, Sycamore, Illinois; vacant lot, Silvis; $48,000.

Titterington, Lowell W. and Phyllis A., trust, Grapevine, Texas, to Acri Property Management, Milan; 10100 120th Ave. W., Taylor Ridge, farm; $300,000.

Godwin, John A., Moline, to Bouzegou, Kamal, Moline; 1026 38th St., Moline; $55,000.

Strauss, Lawrence J., Davenport, to Grizzle, Jim and Jenna Marie, Coal Valley; 2216 E. 7th St., Coal Valley; $190,000.

Pugsley, Joshua W. and Delilah L., Dwight, Neb., to Amenyitor, D'Allen K., East Moline; 3551 4th St., East Moline; $180,000.

Palmer, Skyler, Sterling, to Perez, Ana Maria Alva, and Martinez, Shania, Rock Island; 607 21st Ave., Rock Island; $119,000.

Franks, Floyd E. and Beerly A., Chattsworth, Georgia, to Bogart, Dustin and Nunez, Ilse, Moline; 5337 31st St. Ct., Moline; $170,000.

Turner, Helen B., Moline, to Newman, Michael, Moline; 4623 51st Ave., Moline; $109,900.

Felix Properties, Fort Collins, Colorado, to Cunningham, Jazmine, Moline; 2324 27th St., Moline; $127,000.

Jackson, Lucas M. and Melissa R., Moline, to Maere, Jeremy and Erica, Moline; 3509 56th St. Place, Moline; $257,000.

Campagna, Mary E., Moline, to Adams, Susan, East Moline; 1800 7th St. #11E, East Moline; $51,000.

Wood, Thomas Joseph and Ermalinda M., Moline, to Weis, Tavia Marie Rosa, Moline; 2425 4th St., Moline; $189,900.

Hanson Family Revocable Trust, Moline, to Reinwall, Colton, East Moline; 3946 3rd St. A. Court, East Moline; $250,000.

Hoke, Owen T., Cambridge, to Houston, Jinaya, Rock Island; 2519 5 1/2 Ave., Rock Island; $78,000.

Taets Properties, Bettendorf, to Welsh, Mekayla, and Davis, Trevor, Coal Valley; 119 E. 3rd St., Coal Valley; $140,000.

Collins, James D., estate, Rock Island, to Vols, Taylor, Coal Valley; 511 E. 5th St., Coal Valley; $250,000.

Osterhagen-Brock, Traci, trust, Boonton, N.J., to Pearce, Morgan, Rock Island; 3620 38th St., Unit #8, Rock Island; $150,000.

Weedon, Norma Jo, and West, Penny, Moline, to Baker, Rick, Moline; 1826 16th Ave., Moline; $85,000.

Weeks, Bradley, New Boston, to Wehrle, Jaclyn, Andalusia; 326 6th St. W., Andalusia; $252,500.

Ramos, David; Sinner, David A. and Neva J., trust, Rock Island, to Kraintz, Joseph J. and Carolyn S., Rock Island; 3935 29th Ave., Rock Island; $221,900.

Bassford Construction, Coal Valley, to Fuentes, Jose Cecilio and Elizabeth, Silvis; 1125 22nd Ave., Silvis; $260,000.

Rynott, Donna J., estate, Moline, to Rynott, Michael J., Moline; 2410 29th Ave. Ct., Moline; $74,000.

Lannen, Alyssa, East Moline, to Lannen, David and Summer, East Moline; 721 21st St., East Moline; $32,000.

Hofer, James E., estate, Monmouth, to Hamerlinck, Noah, Reynolds; 16900 105th St. W., Reynolds; $235,000.

Shank, Albert, Milan, to Lopez, Candy, Milan; 513 11th Ave. W., Milan; $135,000.

DeCrane, Derek, Bettendorf, to Roberts, Tylin Alex, Moline; 5201 8th Ave., Moline; $132,000.

Engesser, Amy, and Bogart, Derek, Sherrard, to Platt, Timothy, Rock Island; 4013 4th St., Rock Island; $30,000.

Anderson, Ruth W., estate, Muscatine, to Watson Farms, LLC, Illinois City; 207.42-acre farm, vacant land, Buffalo Prairie; $1,500,000.

Barton, Stephen J., trust, Milan, to Walton, Cornelia, Rock Island; 2820 38th Ave., Rock Island; $139,900.

Fannie Mae, Plano, Texas, to Gimmy, Amy Marie, Rock Island; 2021 17th St., Rock Island; $154,900.

120 Crop AND 34th Street Investments Inc., Davenport, to 34th Street Holdings, LLC, Coal Valley; 110 34th Street AND 120 34th Street, Moline, office/training studio; $400,000.

Edwards, Robert L., Silvis, to Countryman Hardscape & Landscape, East Moline; 1112 & 1116 15th Ave., East Moline, land/lot only; $4,000.

Turner, Bonnie, Sherrard, to VanRycke, Brayden, and Thrap, Abagail, Moline; 2407 4th St., Moline; $152,000.

Nylin, Richard A., Moline, to Steel, Dion, Moline; 1834 15th St., Moline; 1834 15th St., Moline; $161,000.

Khai, Thang Suan and Kim Lam, Broken Arrow, Oklahoma, to Pappas, Margaret, Rock Island; 2142 21st St., Rock Island; $135,000.

Hodson, Brian K., estate, Moline, to Staples, Eric C. and Catherine N., Moline; 2331 29th Ave. Ct. Drive, Moline; $212,000.

Chen, Guoming, and Lin, Yunzhen, Bettendorf, to Wilson-Bahoun, Joceline A., Moline; 3513-3515 35th St., Moline; $180,000.

Silverthorne Development Co., Sycamore, Ill., to Hernandez, Saul Gerardo, Silvis; 600 18th Ave., Silvis; $394,274.

Wilson, Mildred A., estate, Oskaloosa, Iowa, to Lopez, Geman, Milan; 3421 11th St., Rock Island; $45,000.

Cities With the Largest Increase in Home Prices Over the Last Decade

Cities With the Largest Increase in Home Prices Over the Last Decade

Photo Credit: Imagenet / Shutterstock

While the U.S. real estate market appears to finally be cooling down, home price growth has been a defining economic trend in recent years. Over the past decade, which has included recoveries from both the Great Recession and the COVID-19 recession, U.S. home values grew by more than 95%. In comparison, average hourly earnings saw a modest 44% increase, while the Consumer Price Index rose by just 33%. Consequently, housing affordability has taken a hit, while homeowners have seen substantial gains in their real estate wealth.

Home Price Trends Following Economic Recessions

Home price growth after the COVID-19 recession was unprecedented but has now regressed to historical norms

Source: Construction Coverage analysis of U.S. Housing & Urban Development data | Image Credit: Construction Coverage

Recent home price increases, though intensified by the unique circumstances of the COVID-19 pandemic, reflect a broader trend of above-average growth following economic recessions. Historically, U.S. housing markets have rebounded strongly after downturns, with median prices rising by an average of 33.6% over five years (20 quarters). Following the brief 2020 recession, home prices surged by an unprecedented 40% within just over two years but have since stabilized. By the third quarter of 2024—17 quarters after the recession officially ended—cumulative growth stands at 32.6%, closely mirroring historical patterns observed over similar recovery periods.

Despite recent declines in sale prices, homebuyers still haven’t experienced much in the way of financial relief. Persistent inflation continues to erode purchasing power, and mortgage rates above 6% have kept monthly payments near record highs.

Home Price Growth by State Over the Past Decade

States in the West and South Atlantic saw the most significant home price growth over the past decade

Source: Construction Coverage analysis of Zillow data | Image Credit: Construction Coverage

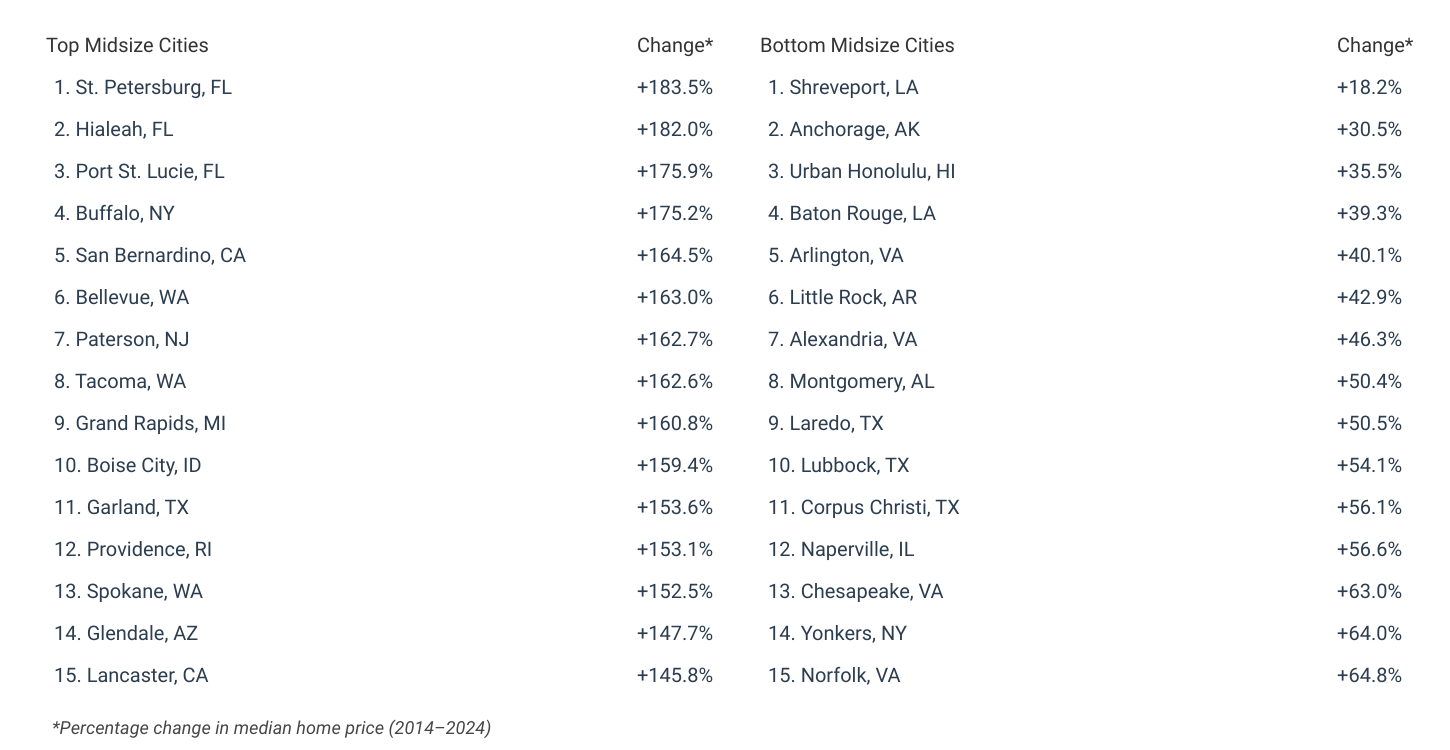

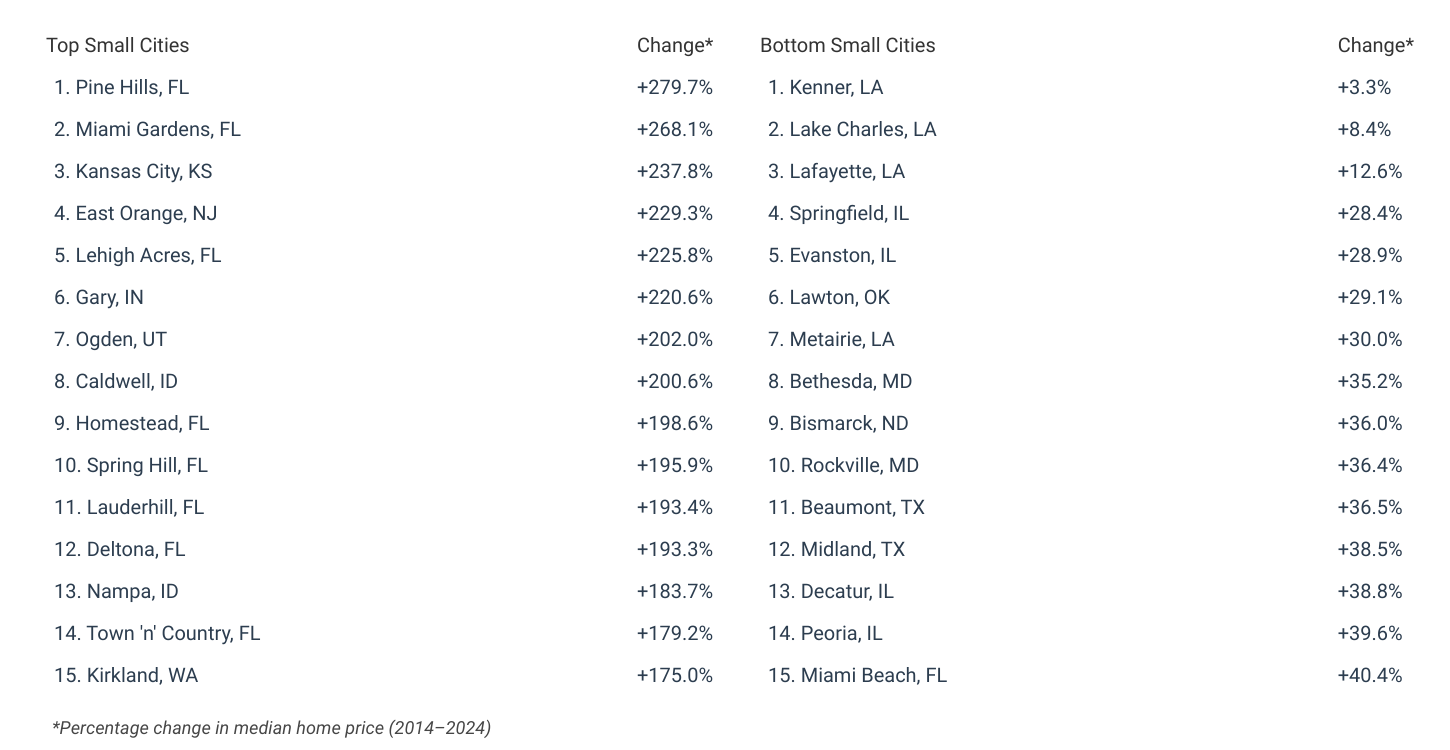

The trajectory of economic recovery post-recession is uneven across the nation, and this trend has held true in the wake of both the Great Recession and the COVID-19 pandemic. The most substantial increases in home prices have been concentrated in Western states and select states in the Southeast. Since 2014, Idaho and Florida have witnessed the most significant growth, with median home prices increasing by 155.5% and 132.2%, respectively. Other top states include Washington (+129.1%), Utah (+127.5%), Georgia (+126.0%), Nevada (+125.7%), Arizona (+123.0%), and Tennessee (+122.6%).

Conversely, Louisiana (+24.1%), North Dakota (+26.7%), and Alaska (+37.3%) saw home price growth barely keeping pace with inflation over the past decade. Generally, the Midwest, along with certain pockets of the South and Northeast, reported the slowest growth in home prices nationally during this period.

At the city level, locations in Florida notably stand out for their remarkable surge in home prices. For instance, in Pine Hills, FL, median home prices skyrocketed from approximately $74,000 in 2014 to over $281,000 today, marking a 280% increase. Seven Florida cities reported price increases of over 190%—roughly twice the national average—over the past decade.

Below is a breakdown of 10-year home price growth across America’s major cities and all 50 states. The analysis was conducted by Construction Coverage, a website that compares construction software and insurance, using data from Zillow. For complete results, refer to the original post on Construction Coverage: Cities With the Largest Increase in Home Prices Over the Last Decade.

Cities With the Biggest 10-Year Increase in Home Price

States With the Biggest 10-Year Increase in Home Price

Methodology

Photo Credit: Imagenet / Shutterstock

The data used in the study comes from Zillow and the U.S. Census Bureau’s American Community Survey. To find the cities with the largest increase in home prices over the last decade, researchers at Construction Coverage compared each location’s median home value in 2014 and 2024. Locations were then ordered by their respective percentage change in median home price over those 10 years, and in the event of a tie, the location with the larger total change in home price over the last decade was ranked higher.

For relevance, only cities with complete data were included, and cities were broken into three cohorts based on population:

- Large: Cities with more than 350,000 people

- Midsize: Cities with 150,000–350,000 people

- Small: Cities with less than 150,000 people

For complete results, see Cities With the Largest Increase in Home Prices Over the Last Decade on Construction Coverage.

U.S. mortgage rates increased this week, reaching their highest levels since July, with the 30-year fixed rate climbing by six basis points to nearly 6.9%. A year ago, the rate was 6.62%. The average 15-year fixed rate rose by thirteen basis points to over 6% compared to nearly 5.8% a year earlier. Freddie Mac’s chief economist, Sam Khater, noted affordability challenges persist, but rising pending home sales suggest renewed buyer activity. Rates are being influenced by elevated bond yields and the Federal Reserve’s stance on controlling inflation, which remains above the 2% target.