Tuesday May 28, 2024

Tuesday May 28, 2024

Monday, 6 May 2024 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market commenced the week ending 26 April 2024 on a positive note, with the bullish momentum from the previous week carrying over. The market continued to rally throughout the week as yields were seen declining considerably on the back of aggressive buying interest and robust volumes.

The secondary bond market commenced the week ending 26 April 2024 on a positive note, with the bullish momentum from the previous week carrying over. The market continued to rally throughout the week as yields were seen declining considerably on the back of aggressive buying interest and robust volumes.

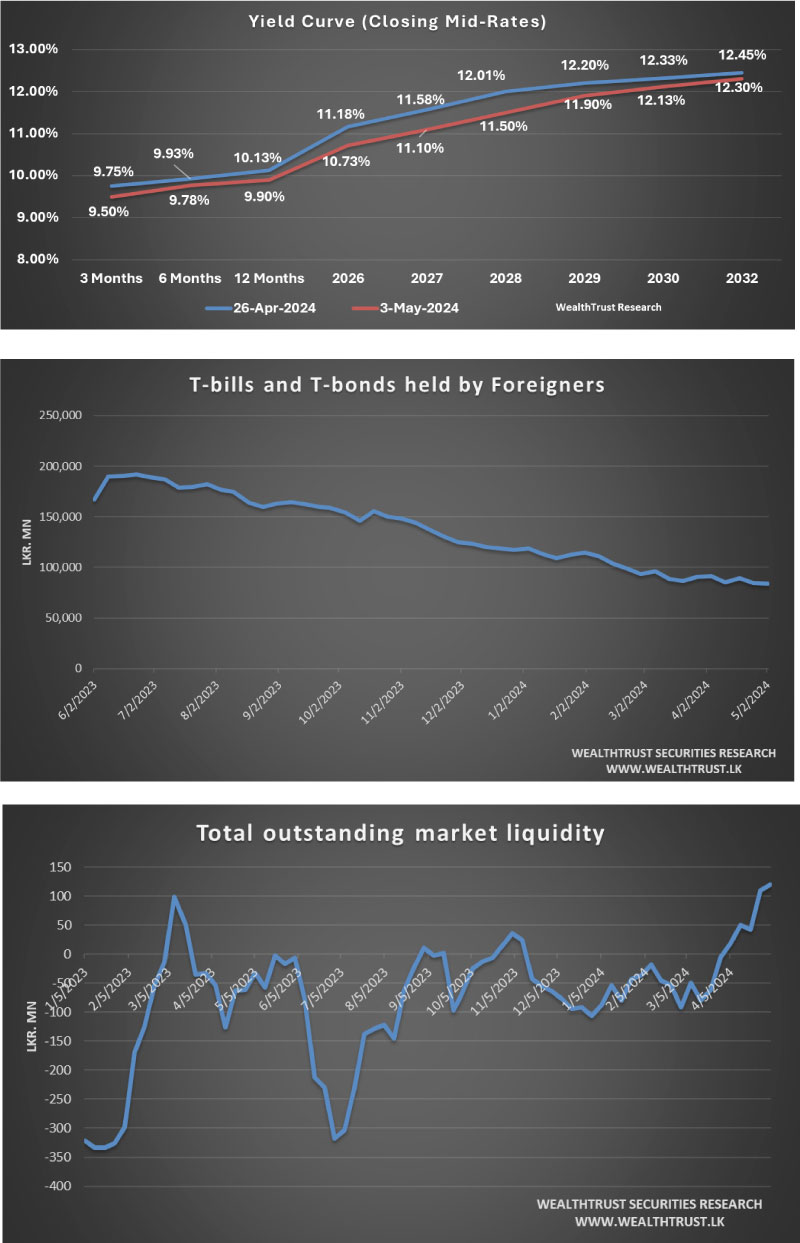

Accordingly, the yield on the liquid 2026 tenor of 15.12.26 was seen nosediving to an intraweek low of 10.70% from its intraweek high of 11.15%. Similarly, the relatively shorter 2026 tenors of 15.05.26 and 01.08.26 were seen trading within the range of 11.05% to 10.55%. Likewise, the liquid 2027 tenors of 01.05.27 and 15.09.27 were seen declining to intraweek lows of 11.00% from intraweek highs 11.60%. The popular 15.03.28 tenor saw frenzied buying in particular, which led it to its yield dropping to an intraweek low of 11.45%, down from its opening highs of 11.95%. This interest was also reflected on the other 2028 tenors of 01.05.28, 01.07.28 and 15.12.28 which changed hands within the range of 11.95% down to 11.50%. Additionally, trades were observed on the medium tenor 15.05.30 and 01.10.32 within the ranges of 12.25% to 12.00% and 12.35% to 12.28% as well.

At the close of the week two-way quotes were seen dropping across the board, leading to a parallel shift downwards in the yield curve. The bullish sentiment was supported by the impressive outcome at the week’s primary auctions and against the backdrop of less than anticipated inflation numbers.

The round of Treasury bond auctions conducted last Monday (29 April) witnessed strong demand for the shorter tenor 15.03.28 bond which was issued at the weighted average of 11.72%, where the entire offered amount of Rs. 25.00 billion was snapped up at the 1st phase of the auction, in competitive bidding. Similarly, the 15.05.30 maturity was also fully subscribed and issued at the weighted average of 12.38%. Meanwhile, the 01.10.32 maturity saw mixed results, with Rs. 35.94 billion raised at the 1st phase at a weighted average of 12.47%. A further Rs. 8.79 billion was raised at the 2nd phase on the 01.10.32 maturity at the weighted average determined at the 1st phase. The total bids received exceeded the offered amount by 2.8 times at the 1st and 2nd phases. Despite this the auction went slightly undersubscribed with 99.72% or Rs. 99.72 billion being raised out of a total offered size of Rs. 100 billion, due to the marginal shortfall on the 01.10.32. Interestingly at the direct issuance window the maximum offered amount of Rs. 5.5 billion was raised on the 2028 and 2030 tenors, at the weighted averages determined at the 1st phase, out of a market subscription of Rs. 37.51 billion.

At the weekly Treasury bill auction conducted last Tuesday (30 April), the weighted average yields declined across all three maturities for a fourth consecutive week and were recorded below 10.00% for the first time since 2 March 2022. Last week’s decline was particularly sharp, with the 91-day maturity falling by 29 basis points to 9.61%, the 182-day maturity by 19 basis points to 9.89% and the 364-day maturity by 22 basis point to 9.99%. The entire offered amount of Rs. 130.00 billion was taken up at the 1st phase, with total bids received exceeding the total offered amount by 2.22 times. A further Rs. 13.00 billion was raised at the 2nd phase across all three tenors at weighted averages determined at the 1st phase, being the maximum amount offered. This was out of a total market subscription of a staggering Rs. 103.82 billion.

On the inflation front, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of April 2024 was recorded at 1.50% on a year-on-year basis as against 0.9% recorded in March 2024. Accelerating for the first time in three months, attributable in part to the low base effect from April 2023. However, the increase in inflation was well below a Bloomberg estimate of 2.5%. In addition, interestingly the CCPI experienced a deflation of 0.8% on a month-on-month basis, driven by ongoing reductions in food prices and a decrease in non-food prices.

The Central Bank of Sri Lanka, which lowered the benchmark lending rate by 50 basis points in March, has said it doesn’t expect a threat to its 5% inflation target despite an up-tick in prices. The monetary authority will hold its next policy review on 28 May 2024. Bloomberg economists in an article titled “SRI LANKA REACT: Below-Target CPI to Spur Further Easing” opined that inflation is expected to further accelerate in the coming months, mainly due to a lower comparison base caused by sharp disinflation in 2023. However, subdued demand and a stronger currency are likely to prevent it from surpassing the Central Bank of Sri Lanka’s 5% target. Allowing the CBSL some scope to provide further support to the recovery through easing measures.

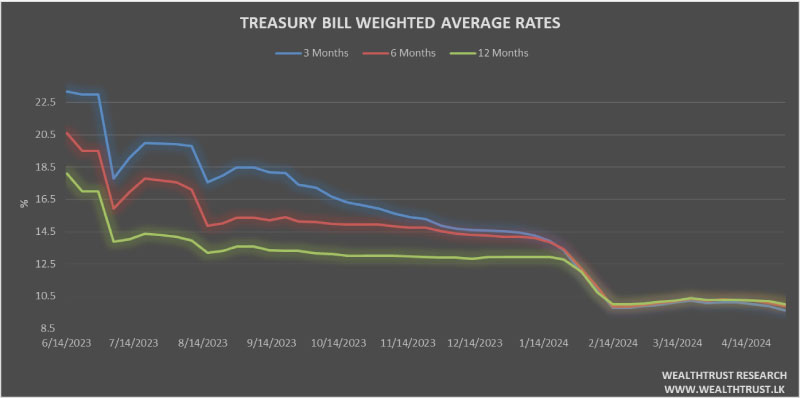

Meanwhile, the foreign holding in Rupee bonds and bills for the week ending 2 May 2024 recorded a net outflow for a second consecutive week, amounting to Rs. 708 million. As a result, the total holding decreased to Rs. 84.13 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first two days of the week averaged at Rs. 61.40 billion.

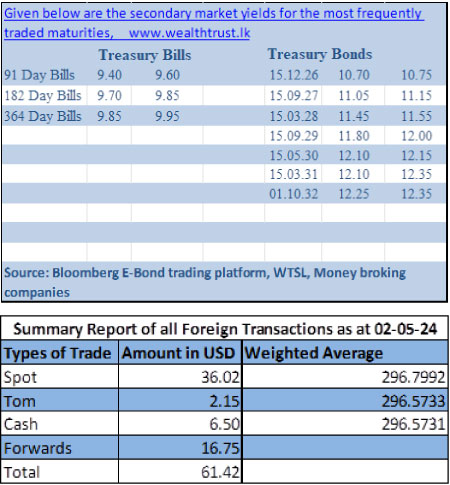

In money markets, the total outstanding liquidity surplus increased to Rs. 120.03 billion by the week ending 3 May from its previous week’s surplus of Rs. 109.29 billion, to the highest level since June 2021. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 8.59% to 8.82%.

The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at

Rs. 2,655.62 billion as at 3 May 2024, down from its previous week’s level Rs. 2,675.62.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating marginally during the week to close at Rs. 297.15/297.35. This is as against its previous weeks closing level of Rs. 296.00/296.30 and subsequent to trading at a high of Rs. 295.96 and a low of Rs. 298.20.

The daily USD/LKR average traded volume for the first four trading days of the week stood at

$ 37.41 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)