Time to wrap up - here are today’s main stories:

Goodnight. GW

Thousands of leaseholders should benefit from leasehold changes, says CMA

Earlier:

Time to wrap up - here are today’s main stories:

Goodnight. GW

Back in Europe, stock markets have closed in the red.

Germany’s DAX (-1.1%), Spain’s IBEX (-1.1%), Italy’s FTSE MIB (-0.95%) and France’s CAC (-0.9%) all finished lower.

Pernod Ricard (+2%) bucked the trend, though, with shares hitting record highs today after the firm behind Jameson, Mumm champagne, Absolut vodka and Martell cognac lifted its annual profit forecast.

The French drinks firm said the pace of recovery is proving stronger than anticipated. as Covid-19 restrictions were lifted.

US new home sales have dropped to a one-year low.

Purchases of new single-family homes fell 5.9% in May, to an annualised rate of 769,000. April’s figures were revised lower too, to 817,000, showing a steeper monthly fall.

Economist had expected a small rise in May, so this is quite a substantial miss.

New single-family home sales fell from 817,000 units at the annual rate in April to 769,000 units in May, a 12-month low. It was the fourth straight monthly decline, pulling back from January’s pace of 993,000 units, which was the strongest pace since December 2006. pic.twitter.com/wqBlUQG5SV

— Chad Moutray (@chadmoutray) June 23, 2021

May new home sales incredibly weak at -5.9% vs. +0.2% est. & -7.8% in prior month (revised down from -5.9%); median new home price +18.1% y/y to $374,400; average selling price at $430,600 … months’ supply up to 5.1 vs. 4.6 in prior month pic.twitter.com/0qlU3c0MHF

— Liz Ann Sonders (@LizAnnSonders) June 23, 2021

The report also showed that median house prices hit a new record.

The median sales prices for new homes jumped to $374,400 in May, a new record and up 18.1% from $317,100 one year ago.

— Chad Moutray (@chadmoutray) June 23, 2021

The fall in sales suggests that the sharp rise in prices in recent months, and the low number of properties available, are weighing on the market.

More details on May new home sales. A year ago, 44% of new home sales were priced below $300,000. In May 2021, only 26% of new home sales were priced below $300,000. https://t.co/zxsQw6NLjL

— Robert Dietz (@dietz_econ) June 23, 2021

The surge in raw materials earlier this year, notably lumber, has pushed up construction costs and encouraged some builders to put projects on hold [lumber prices have since dropped back].

New home sales fall short of expectations, but dropping lumber prices could provide breathing room https://t.co/7s9qb9upka pic.twitter.com/sec3pjEZhK

— MarketWatch Economy (@MKTWeconomics) June 23, 2021

Demand for homes also surged after the Covid-19 lockdown led to more home working, and home-schooling, with people looking for larger homes, perhaps further from their place of work.

That impact could now be fading, through, as vaccinations lead to a return to more normal patterns.

Shipping bottlenecks and higher input prices have held back homebuilding, contributing to skyrocketing prices for the limited supply of homes available. A silver lining of the report was data showing new-housing inventory continued to increase, though about a third of those homes have yet to be built.

Ian Shepherdson at Pantheon Macroeconomics said the sales drop might be a sign that demand in the suburbs has fallen as Covid-19 fears have faded, going so far as calling the end of the boom. By contrast, Stephen Stanley at Amherst Pierpont Securities calls it “mostly an anomaly.”

Sales of new U.S. homes dropped unexpectedly in May as elevated home prices and lean inventory constrained purchases https://t.co/GGjNwvU1Ko

— Businessweek (@BW) June 23, 2021

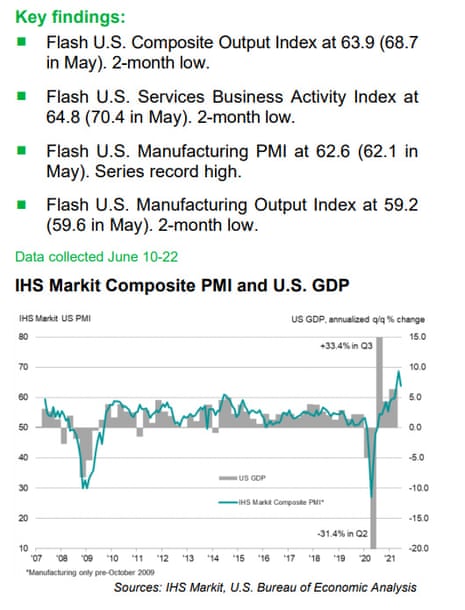

Today’s US PMI report highlights the problems that firms are experiencing hiring staff, says Jai Malhi, Global Market Strategist at J.P. Morgan Asset Management,

“Today’s US PMIs may have calmed but they continue to point toward a speedy rebound in growth, which has taken place since the vaccine rollout kicked into top gear. PMI levels well above 65 were unlikely to last but today’s prints show that the economy may not be at top speed, but is at least progressing nicely.

“The key concern for investors has been around inflation and the survey details highlighted ongoing concerns over supply constraints, which have pushed input prices to near record levels. The fall in the employment component of the surveys is shining a light on the continued difficulty in hiring for businesses as they aim to rebuild their workforces, even though some states have ended enhanced unemployment benefits early. If these supply constraints prove to be temporary then perhaps the slight moderation in the PMIs is good news for investors who may have been worrying about the economy overheating and leading to even higher levels of inflation.

“With the economy appearing more likely to be able to stand on its own two feet, the Fed has begun to plant the seed that policy support will be slowly reduced. The still high level of today’s surveys will provide some confirmation for the Fed that the time to begin taking its foot off the accelerator is not far away.”

Last week, Fed chair Jerome Powell suggested several factors were holding back hiring, including a skills mismatch between people who lost their jobs in the pandemic and the vacancies now on offer; concerns about Covid (especially in customer-facing roles) and childcare responsibilities.

Powell also predicted hiring would pick up as unemployment benefits expire this autumn (such as the $300/week supplement that has ended in some states already).

The US continued to lead the global economic rebound in June, according to flash PMI data from IHS Markit, but also showed signs of growth peaking from May’s record expansion. pic.twitter.com/W4LUbTp8Zp

— Chris Williamson (@WilliamsonChris) June 23, 2021

The rollicking growth across the US private sector has slowed a little, as manufacturers battle with lengthening supply delays and firms struggle to hire staff.

Growth slowed at both service sector firms and manufacturers this month (but remained a healthy pace), as input costs remain very high, and supply chains creak under high demand.

That’s according to IHS Markit’s flash US composite PMI index, which measures activity in the private sector, and which has dropped to 63.9 from May’s 68.7.

That level still shows substantial growth, although it also suggests a slight cooling after surging this year [50 points shows stagnation].

The survey of purchasing managers found that activity growth moderated at both manufacturing and service sectors, with goods producers hampered by significant supplier delays and both sectors reporting difficulties finding qualified workers.

The manufacturing PMI hit a record high, though this was partly due to the recent surge in prices of raw materials and other costs, with average supplier delivery times hitting a record “by some margin”.

Markit reports that new US business growth remained marked during June, although it did drop to a three-month low.

And price pressures are also racing along - input price inflation softened slightly but was still the second-fastest on record.

Manufacturers continued to note rapid increases in raw material and fuel costs, whilst service providers highlighted higher wage bills to attract workers plus greater transportation fees and fuel costs.

And (as in the UK earlier) firms are passing these costs onto customers

Higher costs were commonly passed on to clients through a steep rise in output charges during June. The increase in selling prices was the second sharpest since data collection began in October 2009.

Companies also say they’re struggling to hire suitably trained candidates for current vacancies [suggesting a skills mismatch between the many vacancies on offer, and the people looking for work].

The solution, though, could be to raise wages.... and there are signs in the PMI survey that this is happening.

Markit says:

Service providers stated that wage costs and additional transportation fees pushed up cost burdens, which rose at the second-fastest pace on record.

Although the rate of job creation remained strong overall, backlogs of work grew this month, at one of the fastest rates seen in the last decade.

U.S private sector output expanded rapidly again in June, with the flash #PMI registering 63.9 (May: 68.7), as the easing of COVID-19 restrictions boosted new orders. Manufacturing continued to be hampered by supply delays, however. Read more: https://t.co/sCxiV8ShrB pic.twitter.com/JHv07iJS3r

— IHS Markit PMI™ (@IHSMarkitPMI) June 23, 2021

Chris Williamson, chief business economist at IHS Markit, explains what’s going on:

“The early PMI indicators point to further impressive growth of the US economy in June, rounding off an unprecedented growth spurt over the second quarter as a whole.

“While both output growth and inflows of new orders have come off their peaks in both manufacturing and services, this is as much due to capacity constraints limiting firms’ abilities to cope with demand rather than any cooling of the economy.

“Although price gauges have also slipped from May’s all-time highs, it’s clear that the economy continues to run very hot. Prices charged for goods and services are still rising very sharply, record supply shortages are getting worse rather than better, firms are fighting to fill vacancies and manufacturers’ warehouse stocks are being depleted at a worrying rate as firms struggle to meet demand.

“While the second quarter will likely represent a peaking in the pace of economic growth, a concomitant peaking of inflation is far less assured.”

The technology-focused Nasdaq has hit a fresh record high at the start of trading in New York, as investors continue to drive up shares in tech stocks.

The Nasdaq Composite has opened 0.3% higher at 14,296, up 43 points.

Stocks opened slightly higher Wednesday with the Nasdaq building on the previous session's record close. https://t.co/lwqqTS3pN4 pic.twitter.com/TZZ8zVHV0B

— MarketWatch (@MarketWatch) June 23, 2021

NASDAQ COMPOSITE INDEX HITS RECORD HIGH

— Michael Brown (@MrMBrown) June 23, 2021

Microsoft opened a little higher, currently up 0.1% at $265.80, after yesterday hitting a $2trn valuation for the first time ever.

That made Microsoft just the second publicly traded American company, after Apple, to achieve this huge valuation.

#Microsoft hits a $2 Trillion market cap.

— Ibrahim Misto (@IMISTO77) June 23, 2021

While it took Microsoft 33 years from its IPO to reach its first $1 trillion in value in 2019, the next trillion only took about two years.

Microsoft Becomes Second US Public Company After #Apple to Join $2 Trillion Club.#Bigtech #Tech pic.twitter.com/tZCCvQ1mRL

Microsoft’s market capitalization topped $2 trillion during trading on Tuesday, and closed just $300 million shy of that mark. Its stock on Tuesday climbed 1.1% to $265.51.

The company reached the $2 trillion milestone just over two years after it first passed the $1 trillion market cap mark.

Covid-19 helped get it there. The pandemic meant people were spending more time on their devices, boosting demand for Microsoft’s computers, gaming systems and cloud computing platform. And a stock market rally — along with the success of tech companies in particular — lifted its shares.

The US current account deficit has hit a 14-year high, as America’s economy pulled in more imported goods as its recovery gathered speed.

The current account deficit widened by $20.7bn, or 11.8%, to $195.7bn in the first quarter of 2021, up from $175.1bn in the fourth quarter of 2020.

That was the largest shortfall in the current account since the first quarter of 2007.

It lifts the deficit to 3.6% of GDP, up from 3.3% in Q4, the Bureau of Economic Analysis reports.

America’s widening trade gap was partly responsible, with imports growing faster than exports as the US economy rebounded strongly from the pandemic.

A measure of the nation’s debt to other countries surged in the first quarter to the highest level in 14 years largely because of record U.S. trade deficits during the pandemic. The U.S. current-account deficit increased by $20.7 billion to $195.7 billion. https://t.co/kOqto34YfV pic.twitter.com/xPHJvq025g

— MarketWatch Economy (@MKTWeconomics) June 23, 2021

While goods exports rose by $24.5bn, to $408.6bn, this was outpaced by a $39.9bn jump in goods imports, to $677bn.

The BEA says:

The increases in both [goods] exports and imports reflected increases in nearly all major categories, led by industrial supplies and materials, primarily petroleum and products, that were partly offset by a decrease in automotive vehicles, parts, and engines.

🇺🇸 US current account deficit widened $21bn to $196bn in Q1, or 3.6% of GDP

— Gregory Daco (@GregDaco) June 23, 2021

➡️#Trade deficit widened $16bn to $213bn

Goods deficit: -$15bn as imports⬆️faster than exports

Services surplus: -$1bn

➡️Primary income surplus +$4bn to $50bn

➡️Secondary income deficit: -$1bn to $33bn pic.twitter.com/8HG0hJ0bok

Imports of services increased $1.8bn to $120.2bn, mostly due to a rise in sea freight transport. Exports of services increased $1.1bn to $175.9bn, led by personal travel.

1Q21 current account deficit widened to $195.7 billion vs. $206.2 billion est. & $175.1 billion in prior month (rev from $188.5 billion); now at widest since June 2007 pic.twitter.com/VYzujlqQbQ

— Liz Ann Sonders (@LizAnnSonders) June 23, 2021

Thousands of leaseholders will be refunded unfair ground rents and allowed to buy the freehold of their property at a discounted price after a crackdown on property developers by the competition watchdog.

Persimmon Homes and Aviva have agreed to offer the refunds after the Competition and Markets Authority (CMA) uncovered “troubling evidence” that leasehold homeowners and prospective buyers were overcharged and misled by the UK’s biggest housebuilders.

Campaigners described the new commitments as “life-changing” and a “massive milestone” in the battle to secure a fair deal for property buyers, and called for other developers and freeholders to follow suit.

Aviva, an insurance group that bought freeholds from developers, has agreed to remove ground rent terms that are considered unfair and repay homeowners whose rents doubled.

Persimmon has agreed to offer leasehold homeowners the opportunity to buy the freehold of their property at a discounted price, and will make repayments to some homeowners who have bought their freeholds.

In the US, there was a jump in demand to refinance home loans last week, suggesting houseowners may be anticipating the end of super-low interest rates.

Applications to refinance a home loan rose 3% last week from the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index, while applications for mortgage to purchase a home were only up 1%.

That was despite a rise in mortgage rates (which usually dampens demand), suggesting that people might be trying to lock in low borrowing costs, as the Federal Reserve weighs up the inflation risks as the economy recovers.

Currently the Fed is buying $40bn of mortgage-backed securities each month, through its $120bn QE programme, which has kept mortgage rates low.

Weekly mortgage refinance demand jumps as some fear the end of super-low rates @CNBC @MBAMortgage https://t.co/UFPYNmHWBS

— Diana Olick (@DianaOlick) June 23, 2021

Joel Kan, MBA’s associate vice president of economic and industry forecasting, said refinances increased for the second consecutive week despite a rise in rates.

“Mortgage rates increased last week, with the 30-year fixed rate rising to 3.18 percent - the highest level in a month.

Figures yesterday showed that existing US home sales in May fell for the fourth straight month, as the surge in prices put houses out of reach for many buyers.

MBA: Mortgage Applications Increase in Latest Weekly Survey https://t.co/BC6ADmK5T3 "The seasonally adjusted Purchase Index increased 1 percent from one week earlier." pic.twitter.com/AYsJ1dIGMK

— Bill McBride (@calculatedrisk) June 23, 2021

Representatives from the UK travel industry, including airline cabin crew and pilots, are holding a day of action to urge ministers to reopen the sector and give more financial support to businesses.

They are calling on the UK Government to support a safe return to international travel in time for the peak summer period, by expanding the green list, and remove testing and quarantine requirements for fully vaccinated travellers returning from green and amber locations.

They are also pushing for a package of tailored financial support, including extension of furlough support until April 2022, to help the travel sector and protect jobs.

Events are being held in Westminster, Holyrood in Edinburgh, and in Belfast.

Tim Alderslade, chief executive of Airlines UK - a trade body representing UK carriers, says:

“It is now or never for the government to reopen travel and save what is remaining of the summer season, not just for families desperate to get away but the tens of thousands of jobs which rely upon this once thriving sector.

“Airlines are at the absolute limit of what they can borrow and without a genuine reopening this summer they will require government support to survive.”

Brian Strutton, acting general secretary of pilots union Balpa, said the government must decide if it will “make or break the UK travel industry” this summer.

Colleagues from @belfastairport are kicking off todays events for the #TravelDayofAction.

— BALPA (@BALPApilots) June 23, 2021

It's time to #SpeakUpForTravel. pic.twitter.com/zxMLz8wCWL

Sky News have more details:

Media minister John Whittingdale said he hoped the government would be able to put more countries on the green list of travel restrictions later this week.

Mr Whittingdale told Sky News the list would be reviewed “later this week to make revisions to the green list, and I hope that we can put more countries on to it”.

But he urged people to go on holiday in Britain.

“You can have a great holiday in Britain and I think a very large number of people will decide this year that that’s what they will do,” he said.

Unions have criticised Lloyds Banking Group as it announces the closure of 44 more branches across England and Wales this year.

The Unite union says the move is a “bitter blow for customers, staff and local communities”, at a time when people need support from the financial services sector more than ever.

Unite national officer, Caren Evans, said:

“The decision by Lloyds Banking Group (LBG) to further erode its presence within our communities is baffling. The closure of 44 more bank branches will deny our communities of essential services such as access to cash and experienced highly trained staff. A local ATM is not a suitable alternative to a staffed bank branch.

In recent times LBG has spent significant resource to sell its message of ‘Helping Britain Recover’. Unite seriously question how this decision to walk away from local communities promotes this message at a time when the customers will rely on the financial services sector support more than ever.

According to Unite, 166 full-time equivalent staff will be affected by the decision to close 29 Lloyds Bank and 15 Halifax branches in 2021. Unite says that Lloyds has given the union a commitment that most staff affected will be redeployed, with some voluntary redundancies.

It takes the total number of Lloyds closures this year to 100.

Closure of 44 more Lloyds branches denies communities essential services such as access to cash and experienced staff - @unitetheunion

— Alan Jones (@AlanJonesPA) June 23, 2021

The great #bank branch closure continues: Lloyds Banking Group has today announced the closure of 44 more branches, 29 Lloyds Bank and 15 Halifax.

— simon read (@simonnread) June 23, 2021

Lloyds says that it is seeing “significantly” fewer transactions at these locations, at a time when many customers are moving to electronic banking instead.

Vim Maru, retail director for Lloyds Banking Group, said Lloyds digital banking customers had grown by over four million in five years, to almost 18 million, including 13.6m active app users.

“This means that, like many businesses on the high street, we must change for a future where branches will be used in a different way, and visited less often.

“We’ll continue to invest in our high street presence, as this week we’re opening a new concept Bank of Scotland branch in Edinburgh, the only bank to take up residence in the new St James Quarter.

Lloyds Banking Group announces closure of 44 bank branches https://t.co/C0EA3ZLK1w

— Unite East Midlands (@UniteEastMids) June 23, 2021

The Evening Standard have a list of the branches being closed.

The surge in hiring at UK firms this month is a very encouraging signal, says Dean Turner, Economist at UBS Global Wealth Management:

“Although down from their recent peaks, today’s PMI figures signal that the recovery in the economy charges ahead.

There were some particularly encouraging signals for hiring, although evidence of price pressures and supply constraints continue to feature in the surveys. Encouragingly, the economy continues to respond positively to the easing of restrictions. The recent delay to the final stage of lifting restrictions shouldn’t hamper the recovery in a meaningful way.

The dip in the UK composite PMI this month (to 61.7, from 62.9) suggests the pace of economic recovery may be peaking, says Kieran Tompkins of Capital Economics.

If so, the UK’s monthly GDP growth rates may slow after hitting 2.3% in April.

Inflation pressures do not seem to have peaked, though, he points out, with firms facing rising input costs, supply chain problems, and pressure to raise wages to attract staff.

Tompkins explains:

The fall in the flash composite PMI from a record high of 62.9 in May to 61.7 in June indicates that the pace of the recovery may have peaked. That suggests the monthly rises in GDP will ease back from the 2.3% m/m gain recorded in April. https://t.co/lJ44i1Nwp6 pic.twitter.com/pomMiAd7Y5

— Capital Economics UK (@CapEconUK) June 23, 2021

IHS Markit’s Chris Williamson also warns that the surge in UK growth may have peaked (as the composite PMI dipped to 61.7 this month, from May’s 62.9, showing slightly slower growth).

Williamson adds that inflation could rise further over the Bank of England’s 2% target (it hit 2.1% in May), because firms are seeing input costs, and their own output prices, rising at unprecedented rates.

“Businesses are reporting an ongoing surge in demand in June as the economy reopens, led by the hospitality sector, meaning the second quarter looks to have seen economic growth rebound very sharply from the first quarter’s decline.

There are some signs that the rate of expansion appears to have peaked, as both output and new order growth cooled slightly from May’s record performances, but full order books and a further loosening of virus-fighting restrictions should nevertheless help ensure growth remains strong as we head through the summer.

However, inflation worries have continued to intensify. Record levels of the survey’s price gauges and the further development of capacity constraints hint strongly that consumer price inflation has much further to rise after already breaching the Bank of England’s 2% target in May.

Comments (…)

Sign in or create your Guardian account to join the discussion