J Venkatesh had always wanted to gift his college-going daughter a phone. But the machine operator, who works in a tobacco-manufacturing unit in Secunderabad, could never save enough money to buy a smartphone. Though he had a savings account in a large nationalised bank, he wasn’t able to procure a personal loan due to poor credit score. That’s when Home Credit India, a consumer finance provider, came into the picture. Last year, the company gave Venkatesh a small-ticket loan of Rs 10,000 to buy a smartphone. “I bought an Android phone for Rs 11,000,” says Venkatesh, who had a poor CIBIL score—Credit Information Bureau (India), commonly known as CIBIL, maintains records of all credit-related activity of individuals. The small-ticket loan boosted his credit score, following which he was able to avail two personal loans of Rs 1 lakh and Rs 73,000 within a gap of less than six months between the two loans. “The Home Credit policy is good, efficient and hassle-free. It’s a boon for people like me who have trouble availing loans through the traditional set-up,” he adds.

Customers like Venkatesh, who have mostly been shown the door by traditional banks, now have an easy and accessible solution at the tap of a key. Wooing them are a multitude of financial institutions that have sprung up in the country in the past two-three years, offering loans without lengthy documentation or multiple bank visits.

“We focus on responsible lending to people with little or no credit history, who may be under-served by traditional and formal banking channels. We also help our customers build and strengthen their credit scores to enable them to have better access to loans next time,” says Tomas Hrdlicka, chief marketing officer, Home Credit India.

If it was poor credit score that led Venkatesh to Home Credit, for Terrence Simon, it was the ease of doing business when he opted for a loan from MoneyTap, an app-based credit line facility. “It was the post-demonetisation period and there was a cash crunch. I was on a business trip, sitting in my hotel room and wondering how to raise cash for some big-ticket purchases that I intended to make. I had heard about MoneyTap, which promised instant loans.

On a whim, I downloaded the app, uploaded a few documents and, within 48 hours, I got a loan of Rs 2.5 lakh,” says Simon. The 43-year-old corporate professional, working in a Swedish multinational in Gurugram, now recommends the app to his friends and family. “It all happened without stepping out of the comfort of my room, without having to meet any representative. Such a thing is unimaginable with my bank,” he says.

The lending landscape

‘Fintech’ is the current buzz word in the start-up space. Many players are offering easy solutions to consumers by solving their financial needs through a bouquet of services. Armed with strong investor funding and technology at disposal, a host of consumer lending institutions are providing instant loans to customers. They could broadly be categorised into non-banking finance companies (NBFCs), fintech firms and online peer-to-peer (P2P) lending platforms. NBFCs specialise in meeting the credit needs of niche areas such as personal loans, financing of consumer durables, commercial vehicles, etc. Fintech firms, on the other hand, act as the bridge between an investor and a bank (NBFC or commercial banks). The P2P lending firms are marketplaces, where the lender and borrower are on the same platform with no involvement of a formal financial institution.

“With less than 20 million consumers in this country having credit cards and 70% of the formal consumer credit availed by only 24 million households, the opportunity for fintechs is immense,” says Lizzie Chapman, co-founder and CEO, ZestMoney, a fintech firm. At ZestMoney, the ticket size of loans ranges from Rs 3,000 to Rs 3 lakh. “But our sweet spot is in the Rs 20,000-Rs 50,000 space. These are purchases that are too small to warrant taking a personal loan for, but too big to put in one lumpsum for most people,” Chapman adds.

Today, nearly one-third of the customers availing loans through these financial institutions are new to credit. Most of them are young and hence no credit score is available. So traditional institutions are unable to lend to them. There are two different segments that alternative lenders are targeting. The personal loan industry, driven largely by CIBIL score, as the main underwriting methodology, which offers quick disbursement of loans at attractive rates of interest. Then there are those whose scores are below the cut-off list or are first-time borrowers with a thin or poor credit history.

“The market of unmet finance needs is huge. As per an estimate by the International Finance Corporation in 2012, the viable, addressable, unmet debt finance need of small businesses in India is Rs 2.93 trillion (Rs 2.93 lakh crore),” says Rangan Varadan, founder and CEO of BillionLoans, a P2P marketplace.

Small-ticket lending is still a large white space in India due to the huge number of unbanked and new-to-bank consumers. As per a 2014 World Bank paper, The Global Findex Database 2014: Measuring Financial Inclusion around the World, three countries—India, China and Indonesia—accounted for 38% of the world’s unbanked adults. And the non-formal banking sector is now tapping this market.

“There’s a large portion of the population without access to banking services, let alone credit facilities,” says Sandy Shen, research director, Gartner, a global IT research firm. As per data released in 2016 from the finance ministry, only 28-32% of Indians have access to financial institutions, including post offices and banks.

So it’s not surprising to see the PricewaterhouseCoopers (PwC) Global Fintech Report 2017, which highlights that alternative lending is the second-most funded and one of the fastest growing segments in the Indian fintech space. “We are serving over three million customers through a network of over 17,000 points of sale. Currently, our loan book stands at Rs 2,900 crore. By the end of this year, we aim to be present in another 20 cities, taking our total footprint to 100,” says Hrdlicka of Home Credit India.

The target audience for most of the app-based fintech firms is the middle-income group family.

“Our data-backed research reflected that people are not comfortable going to banks for loans for minimal amounts—anywhere between Rs 3,000 and Rs 2 lakh. On the other hand, asking for money from family and friends always has an embarrassment factor. This is where we thought to launch an innovative, people-friendly credit product that could be tapped in times of need,” says Anuj Kacker, co-founder of MoneyTap.

Every lending firm is trying to woo the customer with a different concept. If someone is offering advance salary then someone else is doling out cash to shop online. “Our loans are similar to salary advance loans or credit card cash withdrawals,” says Akshay Mehrotra, co-founder and CEO at Earlysalary.com, a salary advance mobile app, which has received more than 8.50 lakh downloads so far—it was launched in 2016—and has disbursed over 40,000 loans till date.

Then there is BillionLoans, a marketplace that connects borrowers to lenders directly, using technology and alternative data-based credit analysis. Talking about the genesis of the company, Varadan says, “We have been operating MicroGraam, a similar platform that focuses on the micro-lending segment, for more than five years now (MicroGraam is a peer-to-peer lending platform for rural entrepreneurs). Often during visits to villages and small towns, I was asked by borrowers affiliated to MicroGraam whether we could arrange loans for amounts higher than what they could get through micro-lending—for example, loans for home repairs or small businesses. So demand for such loans has always existed, but the challenge was in fulfilling this demand.”

Boon for borrowers

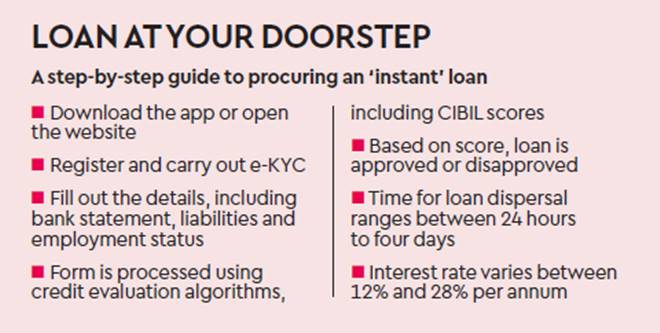

With a plethora of options now available, gone are the days when taking a loan meant standing in queues, meeting the bank branch manager multiple times, flushing out several documents and finally waiting endlessly for approval. Today, if you have a few basic documents in place, fetching a loan is as easy as shopping online.

As a user, you just need to download the mobile app, sign in and enter your PAN, Adhaar and bank account details. While credit bureaus such as CIBIL rate customers based on around 30 parameters, alternative lending start-ups use 500-800 data points. They check an applicant’s CIBIL scores, analyse his or her social media behaviour, shopping history, etc, and build their profile. Within a couple of minutes, the decision to lend money or not is taken. “Around 67% of the total loan applications are approved by machine algorithms in real time without human intervention,” says Mehrotra of Earlysalary.com.

At Faircent.com, a P2P lending platform, tech-enabled credit evaluation algorithms reject over 90% of the borrowers who apply for loans. “Each borrower who registers with us is evaluated based on his ability, stability and intention to repay across 120 parameters processed through access to more than 400 data points. We even undertake physical verification at both home and office,” Rajat Gandhi, founder and CEO, Faircent.com, says.

This swiftness in dispersing loans is something that traditional banks are yet to match. Simon, who had a salary account in a prominent bank for the past 15 years, had a less than pleasant experience taking a personal loan. “Five years back, when I had applied for a personal loan, my bank did a lengthy verification process and they took more than two weeks to sanction a small amount,” he says.

Fintech firms know this all too well. “An average customer takes eight minutes to qualify after opening the app,” says Kacker of MoneyTap, which lets customers borrow as little as Rs 3,000 or as much as Rs 5 lakh, depending on their credit limit set by banking partners. “One has to pay interest only on the funds they use. At the time of withdrawal, one can choose the terms of repayment, which can be anywhere between two months and three years. The interest rate is equivalent to market rates for any personal loan with zero collateral or security. “It can even be as low as 1.25% per month, depending on the partner bank and the credit profile of the user,” says Kacker.

Besides traditional borrowing patterns, the emergence of e-commerce is another avenue to be tapped for financial institutions. “E-commerce is growing fast in India and people may need credit for large-ticket item purchases. Banks don’t lend to everyone, so people without a credit history or collateral assets won’t be able to borrow from banks,” says Shen of Gartner. “These are most likely the kind of people who don’t own credit cards or need higher credit than what is available from the card,” she adds.

The flexible borrowing and repaying option is also an attractive feature.

MoneyTap offers its customers a personal line of credit, wherein once a credit line is sanctioned with an upper limit, one can decide any amount of money from that limit and choose to withdraw only that specific sum from the credit line. Interest would also be charged only on the small amounts borrowed and not on the full amount sanctioned. At EarlySalary, interest rates are something like Rs 9 per day per Rs 10,000 borrowed. At Faircent.com, the average ticket size of loans disbursed is approximately Rs 1.5 lakh, with interest rates starting at 12% per annum and going up to 28% per annum. This is usually less than what most credit cards charge as interest, but a little higher than personal loan rates offered by banks.

Comrade in arms

The online lending landscape in India is evolving rapidly with new-age lenders partnering with a variety of capital providers. As per the PwC report, fintech start-ups have raised over 99% more funding in Q1 2017 as compared to Q4 2016. For the companies running the show, it’s a win-win situation. “From a business perspective, it’s a viable proposition, as these companies usually have higher service charges and interest rates than normal loan facilities from the bank,” says Shen of Gartner.

In May, EarlySalary raised $4 million as Series A funding from IDG Ventures India and DHFL. “We have now started to leverage this equity to raise debt to build our lending ability. We recently announced our Rs 5-million debt raise from IFMR Capital. We are also working towards building Rs 100 crore over the next three quarters,” Mehrotra says.

MoneyTap, launched with RBL Bank as its lending partner, has now signed up with a few more banks. “Some of the smarter banks have realised that instead of investing vast amounts of capital in archaic mainframe computers and expensive real estate, they are better off disaggregating their service into multiple layers and partner with start-ups and other companies to introduce innovative services,” Kacker of MoneyTap says.

BillionLoans has partnerships with ICICI Bank and Yes Bank, as well as NBFCs such as Incred Finance and Vistaar Finance. ZestMoney has also raised funds from multiple players. “Earlier this year, we announced a $6.5-million Series A round led by Naspers-owned PayU, with participation from existing investors like San Francisco-based Ribbit Capital, Omidyar Network and several angel investors,” says Chapman of ZestMoney. But along with partnerships come challenges, primarily sourcing and evaluation. “Our biggest competition is borrowing from friends and family,” says Chapman.

“For the online P2P lending model to be truly successful in India and facilitate large-scale financial inclusion, we need to effectively penetrate the semi-urban and rural markets, where lending is still dominated by the unorganised sector,” says Gandhi. Started in 2014, it receives nearly 30,000 loan requests each month and has disbursed upwards of Rs 20 crore so far.

The other challenge is to keep the partnership with banks and NBFCs going on a sustainable basis. “You can’t take their capital and blow it all up in experimentation, but at the same time we need to push the boundaries and keep growing our business. This is a balance that needs commitment and constant work from both parties,” says Kacker.

Future marketplace

As per the Reserve Bank of India (RBI), personal loans grew 19.4% in value in March 2016 compared with 15% in the year-ago period. “Although the online P2P lending landscape in India is at a nascent stage, the future of the sector is extremely promising. The P2P lending market, currently valued at $3.2 million, is growing by leaps and bounds and is projected to grow as high as $4 billion-$5 billion by 2021,” says Gandhi of Faircent. At present, there are more than 30 specialised online P2P lending platforms operating in the country.

And as the marketplace for lending expands guidelines are being strengthened too. In the 2016 paper, Consultation Paper on Peer to Peer Lending, the RBI categorised P2P lending companies as NBFCs, which will only act as intermediaries and perform the function of connecting lenders with borrowers. Early this month, the RBI issued a notification that said no NBFC can start or carry on the business of a P2P lending platform without obtaining a certificate of registration.

The country has recorded $1.77 billion in fintech investments between 2014 and 2015 through a total of 158 deals, as per tech start-up media platform Inc42’s FinTech Market Report 2014-2016. The average deal size was $9.82 million. The Indian fintech market is expected to reach $2.4 billion by 2020. “The Indian economy is on the growth track that boosts consumer confidence, so people are more likely to be making large purchases. This is not specific to India… we see credit services growing in many parts of the world, for example, North America, Europe, China. So this is a high-growth and lucrative business in many markets,” says Shen of Gartner.

Start-ups are expanding their businesses through speedy loan approvals. “Currently, our customer loan book is growing at 40% on a monthly basis and we are targeting to reach over 30,000 loans per month by the end of this financial year,” says Mehrotra of EarlySalary. MoneyTap has attracted over five lakh installs till date (it was launched in 2016) and aims to reach one million consumers in the next three years.

The fintech firms have now formed an industrial body, Digital Lenders Association of India, that has laid down a general code of conduct for its members, which is likely to ensure more transparency in this nascent sector. “It’s also to highlight any of the challenges we face and (if we) need ecosystem or government help. This has been a very helpful initiative so far,” says Chapman of ZestMoney.

If given a choice, Simon would never take a loan from his salary account ever because it’s “bothersome”. And for Venkatesh, his credit score doesn’t appeal to his bank. And that’s where the success of Indian online lending firms lies.