EJL Wireless Research Reports Global Macrocell BTS Transceiver Market Volumes increased 31% in 2015

Record Shipments despite Grafting Probe in China; China demand slowing down

Some key and notable facts from the analysis include:

LTE technology captured 88% of total shipments, up from 74% in 2014

Overall LTE shipments increased by 55% year over year

TDD-LTE shipments were 50% of total LTE shipments, down from 54% in 2014

Chinese vendors captured 72% of total market shipments, up from 62% in 2014

The green field Band 30 and Band 66 deployments will continue to drive demand in North America. Band 8 900MHz UMTS refarming, Band 20, Band 3, Band 1, Band 7, and the emerging Band 32 SDL products will continue to drive Europe while Band 28, Band 3, Band 33, Band 7, Band 40, and Band 42 will drive demand in Asia Pacific.

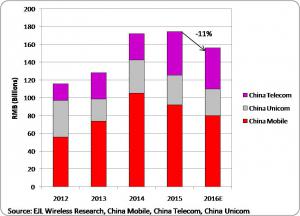

"The mobile infrastructure spending cycle in China hit a peak in 2015 and 2016 will see a decline in spending from Chinese operators that will impact overall base station shipments. The main concern for the industry is the slope of the decline for the next few years as the industry stares into the 5G Chasm. We have published initial projections for 5G infrastructure equipment however it will not fill the demand gap that faces the industry between 2018 through 2020,” says Lum.

Please see our other analysis titled “Global Macrocell Base Station/Remote Radio Unit Market Analysis and Forecast, 12th Edition, 2016-2020” that drives the demand for transceivers.

The RRU architecture migration to higher order 2T4R, 4T4R, and eventually 8T8R architectures for FDD LTE will help soften the decline while the potential for massive MIMO architectures for 5G is a mixed outlook for the industry. The massive MIMO architecture will require less power per radio transceiver, significantly altering the current RRU and passive/semi-active antenna technologies deployed in today's networks.

"EJL Wireless believes that the evolution of outdoor macrocell base station, RRU, and antenna technologies will push mobile operators to continue to delay the mass deployment of small cells and HetNet architectures within their networks,” says Lum.

Some key predictions from EJL Wireless Research LLC for 2016:

Global Macrocell BTS TRx shipments are expected to decline by 33%

Global Macrocell BTS LTE TRx shipments are expected to decline by 32%

Global Macrocell BTS W-CDMA/HSPA TRx shipments are expected to decline by 38%

Global Macrocell BTS CDMA TRx shipments are expected to reach zero by 2019

Global Macrocell BTS GSM/EDGE TRx shipments are expected to decline by 39%

The top suppliers for overall macro base station transceiver shipments as well as by air interface standards for 2015 were:

Overall #1 TRx Supplier: Huawei Technologies

Overall #1 GSM TRx Supplier: Huawei Technologies

Overall #1 W-CDMA TRx Supplier: ZTE

Overall #1 CDMA TRx Supplier: ZTE

Overall #1 LTE TRx Supplier: Huawei Technologies

The report is currently available for purchase and information can be downloaded at www.ejlwireless.com.

About EJL Wireless Research LLC

EJL Wireless Research LLC provides proprietary, accurate, and cutting-edge market analysis and consulting services on the wireless technology ecosystem. The firm's wireless infrastructure research division focuses on all vertical elements of the wireless ecosystem including mobile subscribers, mobile operators, mobile handsets, mobile infrastructure, and mobile content. In addition, the firm provides analysis across horizontal technology suppliers including RF semiconductor materials, RF semiconductor/components, subsystems and OEMs.

EJL Wireless Research LLC believes it has a corporate responsibility, both local and international, in giving back to the community. Please visit our website for more information about the charitable organizations it supports at: http://www.ejlwireless.com/corporate_responsibility.html.

EJL Wireless Research LLC is managed by Earl Lum. Mr. Lum has over 20 years of experience within the wireless industry including 8 years as an Equity Research Analyst on Wall Street covering the global wireless industry. The company is headquartered in Salem, NH. For more information about EJL Wireless Research, please visit the company’s website at www.ejlwireless.com, or our weblog at http://ejlwireless.wordpress.com.

Earl Lum

EJL Wireless Research LLC

6504302221

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.