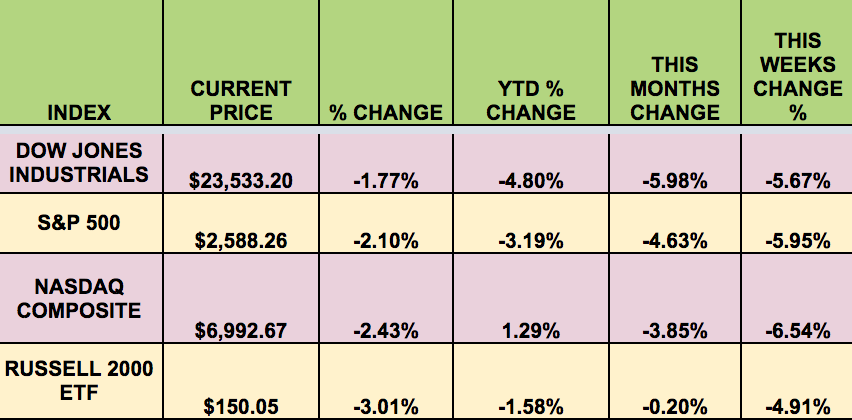

Markets: It was another rough week for the market, with all 4 indexes falling by large percentages, as DC tariffs on Chinese goods and China’s response spooked investors. The Russell 2000 held up the best, but still lost -4.91%. The DOW lost -5.67% and the S&P 500 lost -5.95%, and are now both negative for 2018. The only index in positive territory year to date is the NASDAQ.

“The S&P 500 Index sank 2.5% on Thursday, and 2.10% on Friday, the biggest drop in six weeks, in reaction to trade tariff announcements on at least $50 billion in Chinese imports. As investors dumped stocks, they rushed to the safety of the Treasury bond market, where yields fell back toward 2.8 percent, and the yen, which jumped past 105 per dollar for the first time since November 2016.”

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Apollo Investment Corp (NASDAQ:AINV), BRT, IVR, Armada Hflr Pr (NYSE:AHH), ACRE, AGNC Investment Corp (NASDAQ:AGNC), AHT, ANH, ARI, BCRH, BGS, BXMT, CRT, CVA, EARN, FAT, Granite Point Mortgage Trust Inc (NYSE:GPMT), HT, JMP Group Inc (NYSE:JMP), MITT, American Capital Mortgage Investment (NASDAQ:MTGE), NDRO, NLY, OHA Investment Corp (NASDAQ:OHAI), ORC, PBT, Preferredplus Trust Series Czn 1 Pref (NYSE:PIY), PK, PLYM, PSEC, RLJ, SCM, SJT, SLD, STB, TGLS, TRP, VET, WPC.

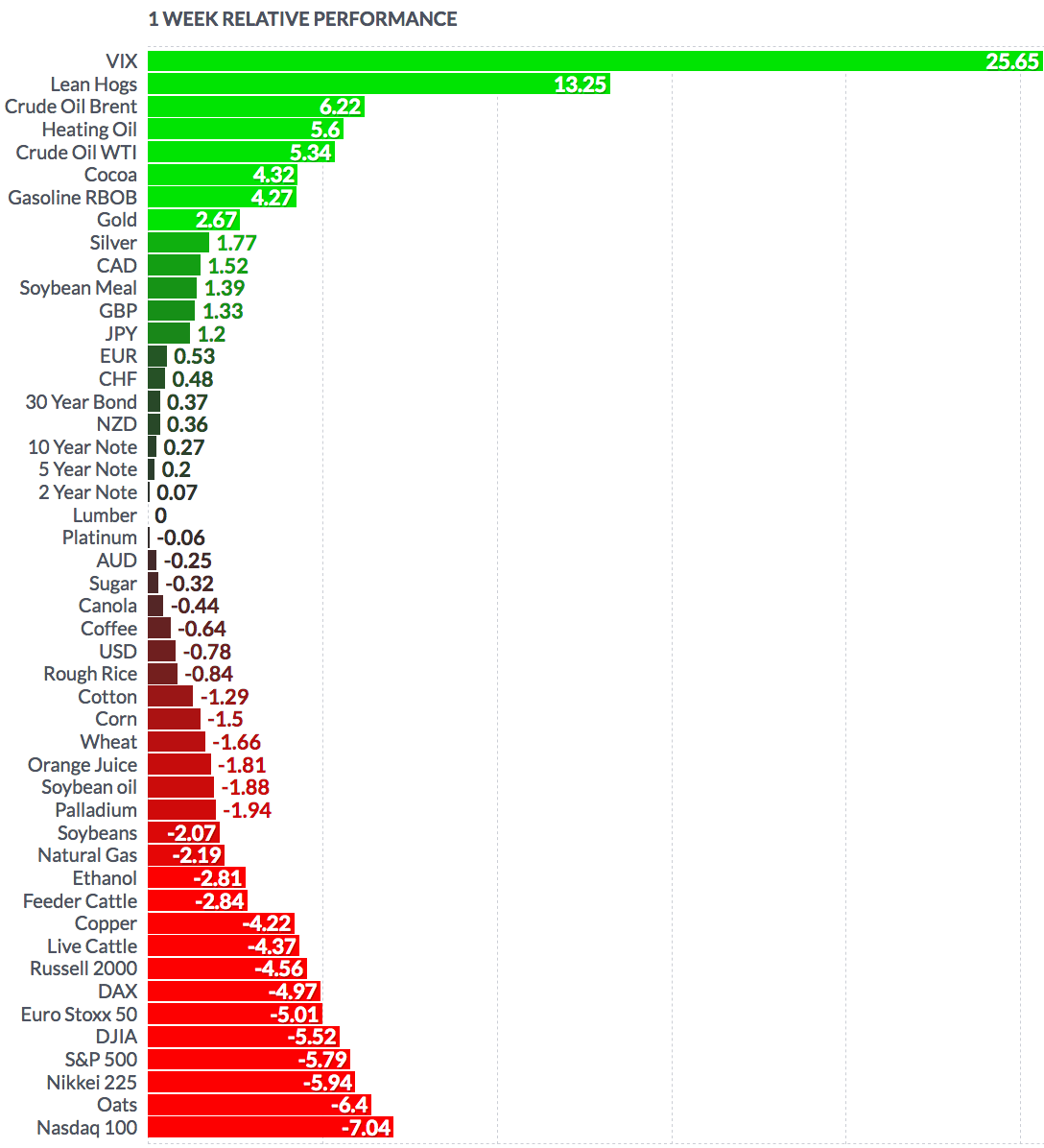

Volatility: The VIX rose 57% this week, ending at $24.87, its highest value since early Feb. ’18.

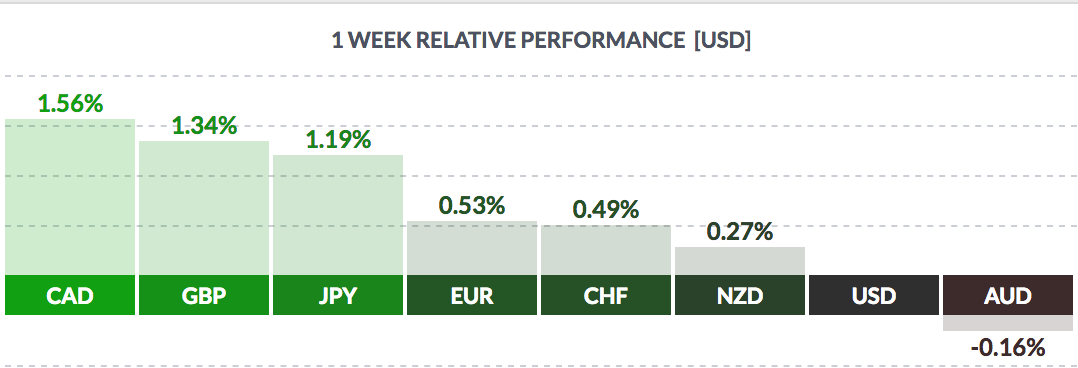

Currency: The USD fell vs. most major currencies this week, except the Aussie $, with a more dovish rate hike stance projected by the Fed.

Market Breadth: Market breadth was nil this week – NONE of the DOW 30 stocks rose this week, vs. 8 last week. ONLY 7% of the S&P 500 rose, vs. 31% last week. This is the worst market breadth we’ve seen in years.

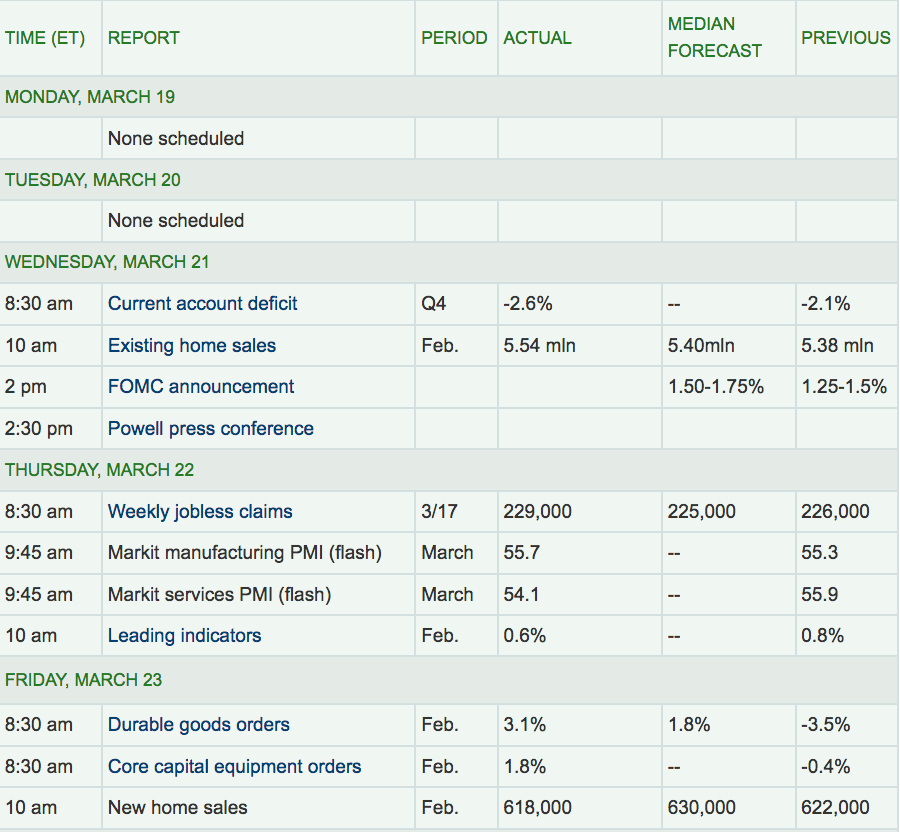

Economic News:The Federal Reserve raised its key interest rate Wednesday in a vote of confidence in the U.S. economy’s durability while signaling that it plans to continue a gradual approach to rate hikes for 2018 under its new chairman, Jerome Powell.

The U.S. dollar posted its largest loss in two months when the Federal Reserve turned out to be less hawkish than anticipated. The Fed raised interest rates on Wednesday and forecast two more hikes for 2018 in its first policy meeting under new Fed Chairman Powell.

Since some investors had expected it to project 3 more rate hikes, the guidance was perceived by some as less hawkish than anticipated, a positive factor for risk assets in general, though analysts noted the Fed was upbeat on the economy on the whole.

They also forecast three hikes next year and two more in 2020 and clearly revised up the growth forecast as well.”

“The effects of the Federal Reserve interest rate hike on Wednesday will extend beyond corporate America to household budgets. Most people will see at least a minor impact on their credit card statements in the next few billing cycles, while those with adjustable-rate mortgages, home equity lines of credit, auto loans and other loans with variable rates of interest will be hit hardest.

Fixed-rate mortgages are also going to become more expensive, which could have a chilling effect on the real estate market. Higher interest rates typically depress home values by making monthly mortgage payments more expensive.

The average rate on a five-year Treasury-indexed adjustable-rate mortgages is currently about 3.67 percent, according to Freddie Mac. ARM rates are modified annually, so a 0.25 percentage point increase in the rate in March wouldnt have an immediate effect. But when it does kick in, it could add up to $1,250 a year to interest payments on a $500,000 mortgage. That mortgage owner could pay an additional $312.50 a month, or $3,750 a year, in interest if the Fed follows through with the three quarter-point hikes that it forecast for 2018 at its December policy meeting. For every 100-basis-point increase in the fed funds rate, historically, it has been the case that the adjustable-rate mortgage rate would go up by 70 basis points” (Source: Reuters)

Existing home sales rose 3% to a 5.54m annualized rate, ahead of forecasts. The Leading Economic Indicators index rose for the 5th straight month, and eight of the 10 indicators that make up the leading index advanced, with the largest gain in average weekly mfg. hours. Building permits and stock prices lagged.

In the 6 months ending Feb. ’18, the leading Economic Indicators Index has climbed 4%, faster than the 2.4% growth during the previous 6 months.

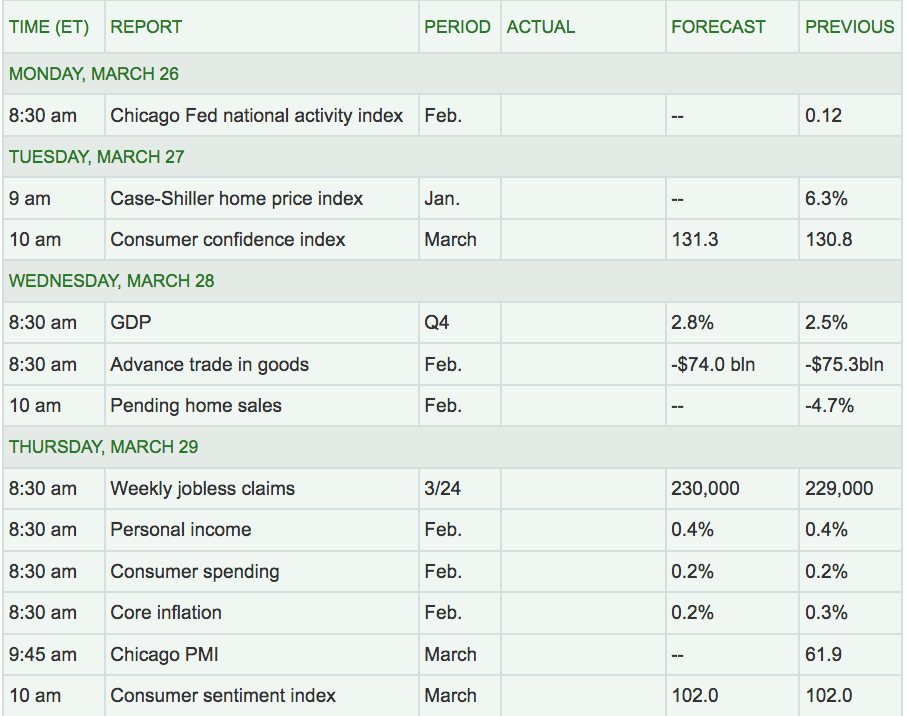

Week Ahead Highlights: It will be a short week, with markets closed on Good Friday, March 30th. There will be reports on Q4 GDP, Consumer Confidence, Home Index prices, and, most likely, a lot more rhetoric about tariffs.

Next Week’s US Economic Reports:

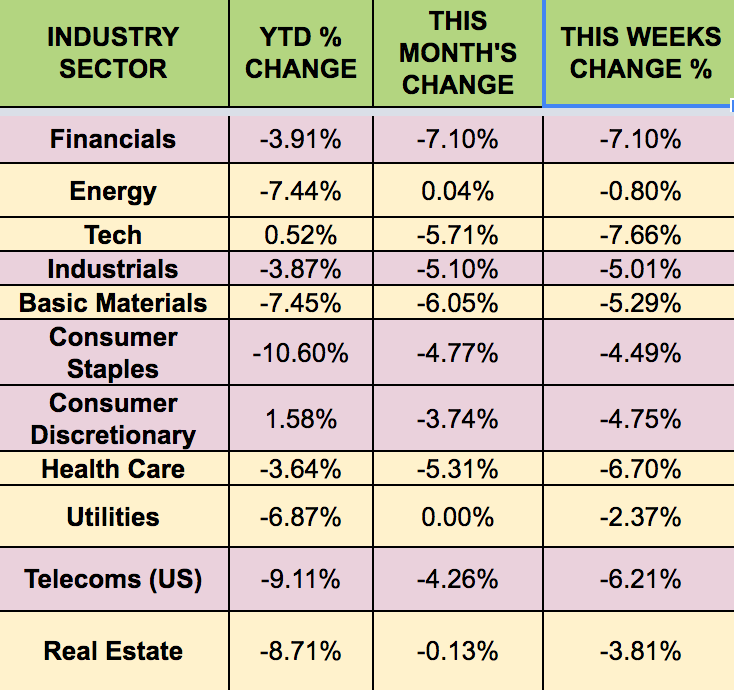

Sectors: All sectors fell again this week, with Energy losing the least ground, and Tech trailing, weighed down by Facebook (NASDAQ:FB).

Futures:

Crude Oil WTI Futures rose 5.3%, while Natural Gas futures fell -2.19%.